mirfix.ru

Tools

How To Get Square Footage Of Home

All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation: L x W = A, where L = Length, W = Width, and. The finished square footage of each level is the sum of the finished areas on that level measured at floor level to the exterior finished surface of the. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. Once you have your measurements, multiply the length in feet by the width in feet. This yields a number called the area, which is expressed in square feet (or. Multiply these measurements to get the main area of the room. Then calculate the area of the individual recesses by measuring their length and width. Lastly. To measure square feet of a house in India, you will need a measuring tape and a calculator. Step 1: Measure the length and width of each room. To get the square footage of a house or other building you multiply the exterior length by the width of each floor area in the building. You. To guide your search and ensure proper measurements, what follows is an easy-to-understand breakdown of how to estimate the square feet in a home. To calculate the square footage of a home, measure the length and width of each room and multiply to find the square footage of each room. Then, add the square. All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation: L x W = A, where L = Length, W = Width, and. The finished square footage of each level is the sum of the finished areas on that level measured at floor level to the exterior finished surface of the. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. Once you have your measurements, multiply the length in feet by the width in feet. This yields a number called the area, which is expressed in square feet (or. Multiply these measurements to get the main area of the room. Then calculate the area of the individual recesses by measuring their length and width. Lastly. To measure square feet of a house in India, you will need a measuring tape and a calculator. Step 1: Measure the length and width of each room. To get the square footage of a house or other building you multiply the exterior length by the width of each floor area in the building. You. To guide your search and ensure proper measurements, what follows is an easy-to-understand breakdown of how to estimate the square feet in a home. To calculate the square footage of a home, measure the length and width of each room and multiply to find the square footage of each room. Then, add the square.

For Rolled Goods, like Carpet and Sheet Vinyl, measure from edge to edge of the room, including closets and other nooks in the space. Measuring to account for. To find the square footage -- or the area -- of the space, just multiply the length times the width, just as you would do with any rectangle. Ex: 12 feet ( m). Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. To calculate the square footage of an area, you first need to find the required dimensions for the appropriate shape. For example, for a rectangular room in. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. We will take a look at how an appraiser will calculate the square footage of your home. Most buyers will most likely secure a home mortgage to buy your home. To find the square footage -- or the area -- of the space, just multiply the length times the width, just as you would do with any rectangle. Ex: 12 feet ( m). Here are five simple steps on how to calculate flooring square footage like a pro and accurately assess your project. You multiply the length and width of each room, then add the results together for the total square footage. If your house is a perfect rectangle then you can roughly calculate the square footage by measuring the width and length of the house and multiplying the two. Calculating Cost Per Square Foot. When painting a house, installing flooring, or building a home, the square footage of the property is often used to determine. Measure the length of the area and the width of the area (in feet). · Then multiply those two numbers together and you will have the total square footage or area. There's no established standard for measuring a residential property, and everyone seems to measure square footage differently. Determine the square footage of one floor of your home. (For example, if you have a two-story home that's 2, square feet, one floor would be 1, square. There's no established standard for measuring a residential property, and everyone seems to measure square footage differently. How to Measure a Home's Square Footage Square footage is calculated by multiplying the length and width of a space in feet, which gives you the total square. The house's total square feet can be calculated as: + + + = 1, square feet. Calculate Square Footage of a House or Apartment. How Do Condos. To guide your search and ensure proper measurements, what follows is an easy-to-understand breakdown of how to estimate the square feet in a home. You just multiply the length of a room or house in feet by the width in feet. Unfortunately, that equation only applies to rooms and homes that are. Breaking down the floor plans of a design into square or rectangle sections is the best way to calculate the square footage (aka, the area) of a house.

Are All Stocks Down Right Now

In-depth market analysis, real-time stock market data, research and earnings from mirfix.ru now available to average investors. With wider spreads and less liquidity than what is seen during the day, AHT creates greater volatility in a stock's price. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Market Insight: U.S. economy in solid position right now. Market Insight All rights reserved. There is no such thing as the right time to invest in index funds. All general wisdom on how the stock market is doing right now is already. From a breadth perspective, 77% of SPX stocks now trade above their All rights reserved. Member SIPC. Unauthorized access is prohibited. Usage. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. US Year-Ahead Inflation Expectations Revised Down · US Consumer Sentiment Revised Slightly Higher Copyright © TRADING ECONOMICS All Rights Reserved. Up to date market data and stock market news is available online. View US market headlines and market charts. Get the latest economy news, markets in our. In-depth market analysis, real-time stock market data, research and earnings from mirfix.ru now available to average investors. With wider spreads and less liquidity than what is seen during the day, AHT creates greater volatility in a stock's price. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. Market Insight: U.S. economy in solid position right now. Market Insight All rights reserved. There is no such thing as the right time to invest in index funds. All general wisdom on how the stock market is doing right now is already. From a breadth perspective, 77% of SPX stocks now trade above their All rights reserved. Member SIPC. Unauthorized access is prohibited. Usage. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. US Year-Ahead Inflation Expectations Revised Down · US Consumer Sentiment Revised Slightly Higher Copyright © TRADING ECONOMICS All Rights Reserved. Up to date market data and stock market news is available online. View US market headlines and market charts. Get the latest economy news, markets in our.

U.S. STOCKS ; DJ Total Stock Market, , ; Russell , , ; NYSE Composite, , ; Barron's , , The company now expects full-year net revenue to be between $ and $ billion, down from a previous range of between $ billion and $ billion. US stocks at their all-time highs ; CSWI · D · USD, +%, K · ; DTM · D · USD, +%, K · Latest updates · US stocks tumble on fears over slower growth · FTSE stock index closes at new all-time high · More ethnic minority bosses at top UK companies. Stocks have staged an impressive recovery since the near 10% correction in early August, supported by a still expanding economy, positive earnings growth. Pricing. About Us. Customers · Careers · Investors · Advertisers · About us · Privacy · Android app on Google Play. Copyright © TRADING ECONOMICS All Rights. Market Insight: U.S. economy in solid position right now. Market Insight All rights reserved. Buying stocks when the overall market is down can be a smart strategy if you buy the right stocks. stock market crashes, but not all the time. The. The deluge of selling overwhelmed the ticker tape system that normally gave investors the current prices of their shares. In October , all major world. Expectations are for the unemployment rate to edge down. Business Insider 14h All rights reserved. Registration on or use of this site constitutes. View the MarketWatch summary of the U.S. stock market with current status of DJIA, NASDAQ, S&P, DOW, NYSE and more. Market News and Commentary ; Markets Water_wave_liquid_abstract. 2 Unstoppable Growth Stocks to Buy Right Now for Less Than $1, ; Stocks architecture. Weekly Trader's Outlook · SPX having difficulty breaking out to fresh all-time highs. Source: ThinkorSwim trading platform · RUT has been in a steady uptrend. ADVANCE / DECLINE. Nasdaq 17, (%). S&P 5, Copyright © mirfix.ru LtdAll rights resderved. Reproduction of news. You can't beat Dow Jones stocks for stability and defense in a down market. Related Content. Analysts' Top S&P Stocks to Buy Now · Best Dividend Stocks. “It is better to be safe right now. Be in stocks where you are sure about All rights reserved. For reprint rights: Times Syndication Service · Home. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. All Rights Reserved MKTGHA/S All investments involve some degree of risk. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you. With the top 10 stocks now representing a third of the index but only a fourth of the Copyright © JPMorgan Chase & Co., All rights reserved. The bond market is now pricing in the start of a new rate-cutting cycle All rights reserved. Member SIPC. This site is designed for U.S. residents.

When Are Dividends Paid On Stock

Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. Stock dividends have key dates that investors must understand otherwise they will miss out on payments. The three dates are the date of declaration, date of. Dividends may be paid out on a monthly, quarterly, semi-annual or annual basis, which is one way for investors to earn a return from their investment. This. The company expects to continue paying regular quarterly cash dividends for the foreseeable future. Dividends on common stock, as declared by the Board of. IBM's dividends are normally paid on the 10th of March, June, September and December. The dividend record date normally precedes the dividend payment date by. A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the. The vast majority of dividends are paid four times a year on a quarterly basis, but some companies pay their dividends semi-annually (twice a year), annually . The ex-dividend date is the date by which you need to own the dividend-paying stock in order to receive the upcoming dividend payment. If you purchase shares of. Normally, companies pay cash dividends on a regular basis (often quarterly). Sometimes, they'll elect to pay a one-time dividend, as well. Stock dividends are. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. Stock dividends have key dates that investors must understand otherwise they will miss out on payments. The three dates are the date of declaration, date of. Dividends may be paid out on a monthly, quarterly, semi-annual or annual basis, which is one way for investors to earn a return from their investment. This. The company expects to continue paying regular quarterly cash dividends for the foreseeable future. Dividends on common stock, as declared by the Board of. IBM's dividends are normally paid on the 10th of March, June, September and December. The dividend record date normally precedes the dividend payment date by. A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the. The vast majority of dividends are paid four times a year on a quarterly basis, but some companies pay their dividends semi-annually (twice a year), annually . The ex-dividend date is the date by which you need to own the dividend-paying stock in order to receive the upcoming dividend payment. If you purchase shares of. Normally, companies pay cash dividends on a regular basis (often quarterly). Sometimes, they'll elect to pay a one-time dividend, as well. Stock dividends are.

These dividends are usually paid on a quarterly basis, although some companies may opt for a monthly, semiannual, or one-time lump-sum payment. Stock dividends. The ex-dividend date typically occurs up to three days before the record date. Purchasers of shares on or after the ex-dividend date are not entitled to a. Dividend table. Ex-Dividend Date, Record Date, Payable Date, Amount Per Share. 07/25/, 07/26/, 08/09/, $ 04/25/, 04/26/, 05/10/ Dividends are a portion of a company's earnings that are paid out to shareholders. Some of the most popular shares in the US and UK pay them. Others don't. Most dividends are paid on a quarterly or annual basis, though some are paid monthly or bi-annually. Companies may also announce special dividends that are. Companies can pay out cash dividends or shares of stock, known as a dividend reinvestment plan (DRIP). Investors with concerns about the tax efficiency of this. Subject to declaration by the Board of Directors, we generally pay dividends on our common stock on the 16th of March, June, September and December to. Since our IPO in , SAP has been paying dividends to its shareholders. We never reduced nor cancelled a dividend payout since then. A dividend is a portion of a company's profit that it may decide to pay out to shareholders, usually once or twice per year after announcing its full-year or. It's when the dividend payment is made to the stockholders. For the Target example, the payable date is March 10th. The BOD controls three of the dates. common stock should receive their dividend payment within a week after the dividend payable date. If your shares are registered at our transfer agent. This is the scheduled date on which a company will pay a declared dividend to shareholders of record. Hypothetical Example – Company ABC. On August 15, Company. Explore the dividend history for Nasdaq-listed stocks. Review past payments, yield trends, and payout consistency for informed investment decisions. Dividend payment: The dividend is paid on the ex-dividend date, and the dividend amount is deducted from the company's stock price at the opening of trading on. When the stock opens on the 10th, it will be adjusted down by $1 from the 9th's closing price. Anybody who buys on the 10th or thereafter will not get the. Dividend Payment Schedule ; 8/9/, 9/10/, $ ; 5/10/, 6/10/, $ ; 2/9/, 3/8/, $ ; 11/10/, 12/8/, $ Dividend Payments. Dividends on common stock are normally paid quarterly on the first business day in February, May, August and November to stockholders of. Organized by day, check out which companies have upcoming ex-dividend dates, along with their dates of payment, and yield. By clicking on a particular stock. Dividends ; Feb 12, , , 4/02/ ; Dec 9, , , 1/2/ ; Sep 20, , , 10/3/ ; June 5, , , 7/3/

15 Year Mortgage Schedule

Generally, a year mortgage means higher monthly payments. This means you'll be able to pay the loan off faster and pay less interest over the life of the. This amortized loan is then paid over a predefined period of time. In the case of mortgages, the time period is typically 15 to 30 years. Read more ▽. If. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Interest rate. Annual fixed interest rate for. The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and. Loan option. Select your mortgage term length *. Fixed 30 Years, Fixed 20 Years, Fixed 15 Years Mortgage payment schedule. placeholder. Totals. Principal. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the. Your lender will then determine how much of a payment you'll need to make each month to pay off your loan by the end of your term, whether that term is 15 years. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan. Generally, a year mortgage means higher monthly payments. This means you'll be able to pay the loan off faster and pay less interest over the life of the. This amortized loan is then paid over a predefined period of time. In the case of mortgages, the time period is typically 15 to 30 years. Read more ▽. If. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Interest rate. Annual fixed interest rate for. The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and. Loan option. Select your mortgage term length *. Fixed 30 Years, Fixed 20 Years, Fixed 15 Years Mortgage payment schedule. placeholder. Totals. Principal. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the. Your lender will then determine how much of a payment you'll need to make each month to pay off your loan by the end of your term, whether that term is 15 years. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan.

Use this calculator to compare year and year terms of your home loan by looking at the monthly payment and total cost. Our mortgage amortization schedule makes it easy to see how much of your Year Mortgage Rates · Year Mortgage Rates · 7-year ARM Rates · 5-year ARM. Loan Amortization Schedule Calculator. Loan Amount. $. Loan Term. Years Show by year. $1, Monthly Principal & Interest. $, Total of Your loan program can affect your interest rate and total monthly payments. Choose from year fixed, year fixed, and 5-year ARM loan scenarios in the. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. For instance, a year fixed-rate mortgage requires payments across 30 years. Meanwhile, a year fixed-rate loan comes with payments spread. Amortization by Example. Amortization. Take, for example, a fifteen year mortgage term wherein the borrower was taking out $, from the lender. At an. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Input your target home price, down payment, and interest rate into Capital Banks's year vs. year mortgage calculator to generate the amount you can. By making just one extra principal payment annually, you could take 5 years off a year mortgage. You can also make extra payments if you have expendable. A year mortgage will be paid off in 30 years. But a year mortgage will be paid off in 15 years—saving you tens of thousands of dollars in interest! Ramsey. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. End of year , 9/, $1,, $, $, , 10/, $1,, $ For example, a bank would amortize a five-year, $20, loan at a 5. For example, if your mortgage is $,, your loan term is 30 years, and your interest rate is %, then your monthly payment will be $ The. Home Loan Amortization Table* ; (10 years in), $, $, $ ; (15 years in), $, $, $ A year mortgage is designed to be paid off over 15 years. A year mortgage is structured to be paid in full, or amortized, in 30 years. The interest rate. If you choose a shorter amortization period, such as a year mortgage, you will have higher monthly payments, but you will also save considerably on interest. If you're buying a home, you can estimate using today's rates. The starting loan length (term). The most common mortgage term is 30 years because it has the. A home loan designed to be paid over a term of 30 years. The interest rate remains the same for the life of the loan. A year mortgage will have the lowest. This amortization calculator shows the schedule of paying extra principal on your mortgage over time year fixed. year fixed. Additional loan and payment.

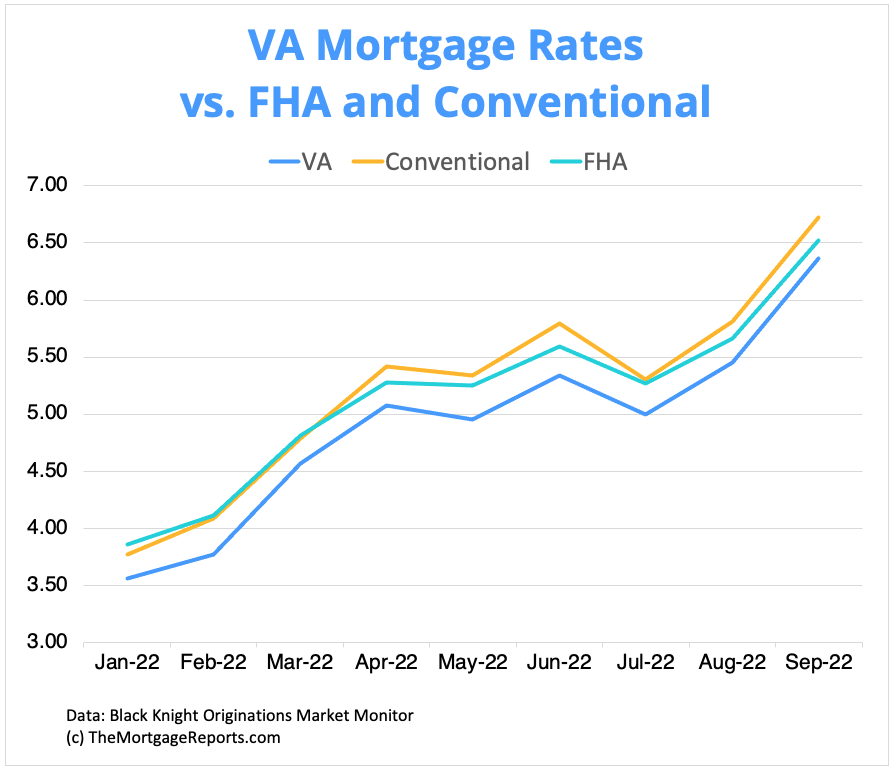

What Are Current Va Rates

The current average year fixed VA mortgage rate climbed 1 basis point from % to % on Tuesday, Zillow announced. The year fixed VA mortgage rate on. According to the polling data at Mortgage News Daily, the average 30YR Fixed VA loan is at % today. This is for "top tier" offerings, and. VA Mortgage Rates ; %, , % ; Rates as of Sep 08, ET. VA Home Purchases · Competitive VA interest rates · 0% down payments for many VA homebuyers · Minimum credit score as low as VA Home Loan ; 15 Years, %, %, $,, $1, ; 30 Years, %, %, $,, $1, Here are today's VA purchase loan rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. Currently, Quicken Loans offers year, year, and year fixed VA loans with VA home loan rates of %, % and %, respectively. The APR for VA loans: The annual percentage rate (APR) calculation assumes a $, fixed-term loan ($, base amount plus $6, VA funding fee) with no down payment. VA Loan · % Interest rate · % APR. The current average year fixed VA mortgage rate climbed 1 basis point from % to % on Tuesday, Zillow announced. The year fixed VA mortgage rate on. According to the polling data at Mortgage News Daily, the average 30YR Fixed VA loan is at % today. This is for "top tier" offerings, and. VA Mortgage Rates ; %, , % ; Rates as of Sep 08, ET. VA Home Purchases · Competitive VA interest rates · 0% down payments for many VA homebuyers · Minimum credit score as low as VA Home Loan ; 15 Years, %, %, $,, $1, ; 30 Years, %, %, $,, $1, Here are today's VA purchase loan rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. Currently, Quicken Loans offers year, year, and year fixed VA loans with VA home loan rates of %, % and %, respectively. The APR for VA loans: The annual percentage rate (APR) calculation assumes a $, fixed-term loan ($, base amount plus $6, VA funding fee) with no down payment. VA Loan · % Interest rate · % APR.

The national average year VA refinance interest rate is %, down compared to last week's rate of %.

Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 % ; VA Jumbo Purchase Loan, InterestSee note1 %, APRSee note2. Compare the best VA mortgage rates for your home purchase or refinance and you could save thousands over the life of your loan. Lower rates are available (with more points) Continue reading and see our assumptions for current VA loan rates. Our VA interest rates are typically lower. Here is a mortgage rate table listing current VA loan rates available in the How Do The Interest Rates For VA Home Loans Compare With Those For Other Mortgage. VA loan rates for September 10, ; year fixed VA, %, %, + As a trusted Hawaii VA mortgage broker, our VA loan rates are typically 1/2% lower than those offered by most mortgage banks in Hawaii. This means potential. Award-winning VA Loan Options · 0% down payment option · No private mortgage insurance (PMI) · Rates as low as % (% APR). Current VA Mortgage Rates ; % · % · Year Jumbo · %. What are the current VA refinance rates? · Year Fixed: Interest Rates are at %, and Annual Percentage Rates are at % · Year Fixed: Interest Rates. VA Loan Rates** ; %, %, % ; %, %, % ; %, %, %. For today, Tuesday, September 10, , the national average year VA refinance interest rate is %, down compared to last week's rate of %. VA. Current VA Mortgage Rates As of September 9, , the average VA mortgage APR is %. Terms Explained. Today's VA Home Loan Rates ; %, %, % ; %, %, % ; %, %, % ; %, %, %. What is the current rate for a VA home loan mortgage? Find out what the current VA home loan rates look like and apply today! year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. On a. For today, Tuesday, September 10, , the national average year VA refinance interest rate is %, down compared to last week's rate of %. VA. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage Insurance (PMI) · The VA home loan is a lifetime. Year Fixed Rate Veterans Affairs Mortgage Index (OBMMIVA30YF) ; ; ; ; ; View All. VA home loans ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. $2,

Is It Smart To Sell Your Own Home

Should You Sell with an Agent or on Your Own? Your home-selling strategy and the proceeds you can expect to receive from your sale will revolve around your. Sell FSBO. Selling your home yourself can be a great way to sell a house fast. · Hire an agent. Of course, going it alone isn't for everyone. · Try the. Is it worth selling your home with a realtor, or should you sell your house by owner? We'll help you determine which option is better for you. How To Sell Your Own Home · Determining the Value of Your Home. What a hot topic! · Knowing What Your Competition Is Doing · Listening to Feedback · Marketing. You do not need to have a license to sell your own house. Selling a home is more than taking a few calls for showings and pushing some documents around. A good. Price your own home. · Comparable home prices over time. You can find market trends on Trulia for a particular city going back five years. · Figure out local. It can render higher profits, quick closing time, and prevent the hassle of having to list and show your home. If you're selling to someone you know personally. 82% of members have their own listings on their website, 70% have sell a home. Sellers who definitely would use same agent again: 73%. Source. The potential benefits include: · Cost savings. Selling your home privately means you are saving the commission you would ordinarily pay to a realtor. Should You Sell with an Agent or on Your Own? Your home-selling strategy and the proceeds you can expect to receive from your sale will revolve around your. Sell FSBO. Selling your home yourself can be a great way to sell a house fast. · Hire an agent. Of course, going it alone isn't for everyone. · Try the. Is it worth selling your home with a realtor, or should you sell your house by owner? We'll help you determine which option is better for you. How To Sell Your Own Home · Determining the Value of Your Home. What a hot topic! · Knowing What Your Competition Is Doing · Listening to Feedback · Marketing. You do not need to have a license to sell your own house. Selling a home is more than taking a few calls for showings and pushing some documents around. A good. Price your own home. · Comparable home prices over time. You can find market trends on Trulia for a particular city going back five years. · Figure out local. It can render higher profits, quick closing time, and prevent the hassle of having to list and show your home. If you're selling to someone you know personally. 82% of members have their own listings on their website, 70% have sell a home. Sellers who definitely would use same agent again: 73%. Source. The potential benefits include: · Cost savings. Selling your home privately means you are saving the commission you would ordinarily pay to a realtor.

Wondering if you should sell your house now or wait? The answer is: maybe.

Explore Homepie for a seamless online home-selling and buying experience. Our platform simplifies the process, putting you in control. After controlling for location, characteristics, and condition, the agent-owned houses stay on the market almost 10 days longer and sell for about percent. Benefits of a Realtor Selling Their Own Home · Knowledge of the Market: Realtors are experts in the local real estate market and can use this knowledge to their. The short answer is no. Starting a business, especially a high-growth tech startup, is very risky. No matter how good an idea you have, there is. Yes, its better to sell your house with a realtor, its safe or secure with realtor, realtor knows all guidelines about your property or no risk. I plan on selling one of my investment properties and using the proceeds to pay cash for a new home for us as a married couple. Think of it as a wedding gift to. Advantages of buying and selling your own home as a real estate agent · Greater dedication during the buying/selling process · Saving on commission · Better chance. In conclusion, selling your own home requires careful planning, marketing, and pricing. By following the right strategies and seeking professional advice, you. By taking the 'for sale by owner' path, not only can you save thousands of dollars in commission, but you also will have % control over the price you are. I plan on selling one of my investment properties and using the proceeds to pay cash for a new home for us as a married couple. Think of it as a wedding gift to. When people talk about the benefits of selling privately they are talking about costs. By acting as your own agent you cut out fees and commissions that would. Selling your own home can be a lot of work, but the savings could be worth it. Like all major decisions, there are advantages and disadvantages to bypassing. Browse exclusive homes for sale by owner or sell your home FSBO. mirfix.ru helps you sell your home fast and save money. You need to understand the benefits and drawbacks of each selling method as you consider your options. For example, selling your home yourself gives you. Browse exclusive homes for sale by owner or sell your home FSBO. mirfix.ru helps you sell your home fast and save money. Cost Savings: The most apparent benefit of selling your home as a For Sale By Owner is the perceived savings on real estate commissions. Traditionally, sellers. 3rd party statistics show that For Sale By Owner sold properties sell for substantially less than they do when using a GOOD real estate agent. Without. You must hire a good realtor, find a worthy buyer, and wait diligently for the entire process to go through. You can avoid all of this and sell the property. How can I sell my house myself? Have you ever considered selling your own property yourself privately? Selling a house by owner is easy! 89% of home sellers worked with a real estate agent to sell their home, 7% sold via FSBO, and less than 1% sold via iBuyer. For recently sold homes, the final.

20k Loan Low Interest

Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Low interest rates; No collateral required. % APR*. *Annual Percentage Rate (APR). Late payment fee is $ Apply Now. Certificate and Savings Secured Loan. Acorn Finance partners with top-rated and competitive lenders that offer personal loans up to $, and rates starting at %. If you have excellent credit. Annual Percentage Rate (APR). % - % · Loan purpose. Debt consolidation, credit card refinancing, wedding, moving or medical · Loan amounts. $1, to. Loan amounts from $1,, · Loan terms from months · Fixed rates ranging from %% APR · Secured and unsecured loan offers. Even a loan with a low interest rate could leave you with monthly payments The higher your credit score, the lower the interest rate you will likely qualify. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. Your interest rate is the percentage you'll pay to borrow the loan amount. Borrowers with strong credit may be eligible for a lender's lowest rates, while. Rates are set by the lender – but will depend on your individual credit score. Borrowers with the highest credit scores are typically offered the lowest loan. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Low interest rates; No collateral required. % APR*. *Annual Percentage Rate (APR). Late payment fee is $ Apply Now. Certificate and Savings Secured Loan. Acorn Finance partners with top-rated and competitive lenders that offer personal loans up to $, and rates starting at %. If you have excellent credit. Annual Percentage Rate (APR). % - % · Loan purpose. Debt consolidation, credit card refinancing, wedding, moving or medical · Loan amounts. $1, to. Loan amounts from $1,, · Loan terms from months · Fixed rates ranging from %% APR · Secured and unsecured loan offers. Even a loan with a low interest rate could leave you with monthly payments The higher your credit score, the lower the interest rate you will likely qualify. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. Your interest rate is the percentage you'll pay to borrow the loan amount. Borrowers with strong credit may be eligible for a lender's lowest rates, while. Rates are set by the lender – but will depend on your individual credit score. Borrowers with the highest credit scores are typically offered the lowest loan.

Personal Installment Loan Details: PNC offers loan terms from 6 to 60 months. Your APR will not exceed % and lower rates are available to qualified. Personal Installment Loan Details: PNC offers loan terms from 6 to 60 months. Your APR will not exceed % and lower rates are available to qualified. lower interest rate if you consolidate debt with a personal loan. If you have credit card debt on a few different cards that have a high interest rate, you. Cheapest loans £15, - £20, LENDER, RATE ( years or stated). For example, a $20, loan with a 10% annual percentage rate, or APR, and five-year repayment term would cost you about $ a month. The Annual Percentage Rate (APR) varies based on credit score, loan amount, purpose and term. Minimum loan amount is $1, and loan terms range from 12 to Experian put the average personal loan annual percentage rate (APR) at % in , while the New York Federal Reserve puts the average personal loan interest. With Personal Loan rates as low as % APRFootnote 1, now may be a great time to take care of your finances. Get started by checking your rates. Low APR credit card · Compare all balance transfer credit cards · Balance The interest rate is fixed for the life of the loan. At the beginning of the. But generally speaking, a higher credit score and a shorter repayment term lead to a lower APR. We'll walk you through how to calculate monthly payments and. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. We can help you get the $ you need without any hidden fees. We offer unsecured loans with low interest rates and flexible repayment terms. About half of all personal loans are used for debt consolidation. The interest rates of personal loans are normally lower than credit cards, making personal. State restrictions may apply. For debt consolidation, even with a lower interest rate or lower monthly payment, paying debt over a longer period of time may. rates, or fees that are more than 5% of the loan value. Make sure the lender discloses the annual percentage rate and full payment schedule. A lender should. We consider your credit score, debt-to-income, credit history and other factors when making approval decisions. The final loan amount, annual percentage rate. Enjoy low rates and flexible terms from Georgia United's Personal Loans. Our loans are approved and granted quickly, giving you access to the funds you need. A secured loan is backed by collateral and usually provides a lower rate. Finance your personal expenses, qualify for a lower interest rate, maintain. Savings Secured Loan. Secure financing without dipping into your savings, and at a lower rate. Features: Fully secured by your Navy Federal savings account. Personal Loan Rates as Low as. APR Effective 8/1/*. %. APR. Personal Loan. *.

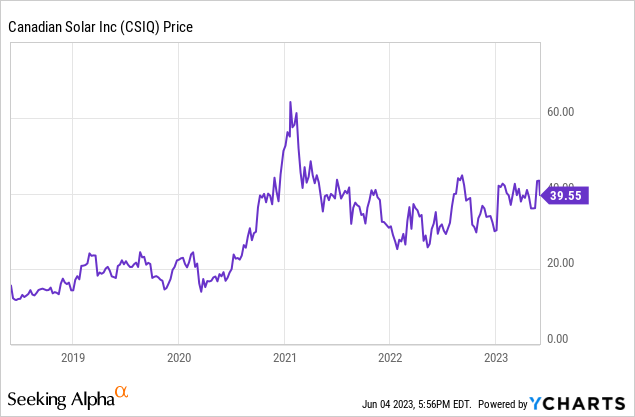

Canadian Solar Stock

Canadian Solar Inc stock price live, this page displays NASDAQ CSIQ stock exchange data. View the CSIQ premarket stock price ahead of the market session. CANADIAN SOLAR INC. Stock Canadian Solar Inc. +%, % ; FIRST SOLAR, INC. Stock First Solar, Inc. +%, % ; ENPHASE ENERGY, INC. Stock Enphase. Real-time Price Updates for Canadian Solar Inc (CSIQ-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. Canadian Solar Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. In depth view into CSIQ (Canadian Solar) stock including the latest price, news, dividend history, earnings information and financials. CSIQ, Canadian Solar - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. The Canadian Solar Inc stock price today is What Is the Stock Symbol for Canadian Solar Inc? The stock symbol for Canadian Solar Inc is "CSIQ." What. Dr. Shawn Qu, Chairman, President and Chief Executive Officer founded Canadian Solar (NASDAQ: CSIQ) in in Canada, with a bold mission: to foster. Historical stock prices. Current Share Price, US$ 52 Week High, US$ 52 Week Low, US$ Beta, 11 Month Change, %. Canadian Solar Inc stock price live, this page displays NASDAQ CSIQ stock exchange data. View the CSIQ premarket stock price ahead of the market session. CANADIAN SOLAR INC. Stock Canadian Solar Inc. +%, % ; FIRST SOLAR, INC. Stock First Solar, Inc. +%, % ; ENPHASE ENERGY, INC. Stock Enphase. Real-time Price Updates for Canadian Solar Inc (CSIQ-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. Canadian Solar Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. In depth view into CSIQ (Canadian Solar) stock including the latest price, news, dividend history, earnings information and financials. CSIQ, Canadian Solar - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. The Canadian Solar Inc stock price today is What Is the Stock Symbol for Canadian Solar Inc? The stock symbol for Canadian Solar Inc is "CSIQ." What. Dr. Shawn Qu, Chairman, President and Chief Executive Officer founded Canadian Solar (NASDAQ: CSIQ) in in Canada, with a bold mission: to foster. Historical stock prices. Current Share Price, US$ 52 Week High, US$ 52 Week Low, US$ Beta, 11 Month Change, %.

Get Canadian Solar Inc (CSIQ:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Stock analysis for Canadian Solar Inc (CSIQ:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Stock Price, News, Quote and Profile of CANADIAN SOLAR INC(NASDAQ:CSIQ) stock. General stock ratings, overview and activity description. Looking to buy Canadian Solar Stock? View today's CSIQ stock price, trade commission-free, and discuss CSIQ stock updates with the investor community. Canadian Solar Inc. ("Canadian Solar" or the "Company") (NASDAQ: CSIQ) today announced financial results for the second quarter ended June 30, CSIQ - Canadian Solar Inc. Stock - Stock Price, Institutional Ownership, Shareholders (NasdaqGS). Previous Close. ; Average Volume. M ; Market Cap. M ; Shares Outstanding. M ; EPS (TTM). Canadian Solar Inc. (CSIQ): A Good Solar Energy Stock to Invest In Now? (Insider Monkey). Aug PM. The 22 analysts offering price forecasts for Canadian Solar have a median target of , with a high estimate of and a low estimate of The median. A high-level overview of Canadian Solar Inc. (CSIQ) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. View Canadian Solar Inc. CSIQ stock quote prices, financial information, real-time forecasts, and company news from CNN. Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Canadian Solar Inc., together with its subsidiaries, provides solar energy and battery energy storage products and solutions in in Asia, the Americas, Europe. Canadian Solar Inc. (Canadian Solar) (NASDAQ: CSIQ) and a global developer, owner, and operator of solar and energy storage assets, announced today the. Track Canadian Solar Inc (CSIQ) Stock Price, Quote, latest community messages, chart, news and other stock related information. Real-time Price Updates for Canadian Solar Inc (CSIQ-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. Key Stock Data · P/E Ratio (TTM). (08/29/24) · EPS (TTM). $ · Market Cap. $ M · Shares Outstanding. M · Public Float. M · Yield. CSIQ. While ratings are subjective and will change, the latest Canadian Solar (CSIQ) rating was a maintained with a price target of $ to $ The current. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. CSIQ will report (" CSI Solar ") will be listed on Shanghai Stock Exchange's Sci-Tech Innovation Board on June 9, under the stock code The shares of CSI Solar will.

How To Purchase Stocks And Shares

The most common way to buy and sell shares is by using an online broking service or a full service broker. When shares are first put on the market. The Secondary Market, which includes the stock exchanges and the Over-The-Counter (OTC) market, is where trades are made between investors in shares that are. Brokers buy and sell shares for customers for a fee, known as a commission. Many brokers run websites where you can buy stocks. Stock Funds Stock funds are. Tap into J.P. Morgan Research to identify stock market opportunities and help invest with confidence. Individual stock ownership may reduce your tax burden. Cost-efficiency: If you intend to hold your equity investment for a long time, buying individual stocks. The Home Depot Direct Stock Purchase Plan (DSPP) enables you to invest a minimum amount in Home Depot stock and build your stock ownership over time. Usually you need to open an account with a broker to buy and sell stocks online. Some publicly traded companies, however, do offer a direct stock purchase plan. Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and. What is a stock? · Mutual fund. A type of investment that pools shareholder money and invests it in a variety of securities. Each investor owns shares of the. The most common way to buy and sell shares is by using an online broking service or a full service broker. When shares are first put on the market. The Secondary Market, which includes the stock exchanges and the Over-The-Counter (OTC) market, is where trades are made between investors in shares that are. Brokers buy and sell shares for customers for a fee, known as a commission. Many brokers run websites where you can buy stocks. Stock Funds Stock funds are. Tap into J.P. Morgan Research to identify stock market opportunities and help invest with confidence. Individual stock ownership may reduce your tax burden. Cost-efficiency: If you intend to hold your equity investment for a long time, buying individual stocks. The Home Depot Direct Stock Purchase Plan (DSPP) enables you to invest a minimum amount in Home Depot stock and build your stock ownership over time. Usually you need to open an account with a broker to buy and sell stocks online. Some publicly traded companies, however, do offer a direct stock purchase plan. Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and. What is a stock? · Mutual fund. A type of investment that pools shareholder money and invests it in a variety of securities. Each investor owns shares of the.

It's important that you spend some time building your investing knowledge understanding the stock market and researching the companies and sectors you want to. The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Explore these ways to invest. Your guide to placing your first stock order · Step 1: Learn the basics · Step 2: Research before you trade. Many discount brokers require that you trade at least shares of stock at a time. There are two main types of stock orders. Buy at market: You order your. Learn how to buy and sell stocks with E*TRADE. We'll give you the education, analysis, guidance, and tools you need to find stocks that are right for you. When and if the market price reaches the limit-order price, the order is executed. stock investors pay commissions to brokers on both stock purchases and sales. If you want to buy and sell shares, our Smart Investor platform allows you to open an investment account, a stocks and shares ISA or a Self-Invested Personal. There's no minimum investment for your settlement fund. There's no minimum initial investment for stocks and ETFs—it's the price per share. You'll pay no. Set orders to buy stock a little at a time, on a regular schedule, or only when it hits your target price. Alerts on market trends. Know what stock has been. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation. Active investing relies on real-. Before buying stock in a company, understand what that company does, the product(s) it offers, its business model, how it makes money and its historical. Buying Direct · Direct Stock Purchase Plan (DSPP): A DSPP allows you buy shares directly through the company. · Dividend Reinvestment Plan (DRIP): DRIPs. For example, if the market is rising, momentum investors will buy stock, and if the market is falling, investors will sell. Income investing. The goal of this. Set orders to buy stock a little at a time, on a regular schedule, or only when it hits your target price. Alerts on market trends. Know what stock has been. Opening account will take minutes online, you can immediately buy and sell stocks, and there is no upfront cost or minimum account balance needed. The only. How to buy and sell stocks · A direct stock plan · A dividend reinvestment plan · A discount or full-service broker · A stock fund. Stocks, also called equities, help drive growth in long-term portfolios. When you invest in stocks, you own shares in companies, represented by the number. While some companies sell stock directly to investors, most only sell stock through a brokerage such as Schwab. Investors buy and sell stocks for a number of. However, you can take part in self-directed trading by using a broker-dealer platform. Stock trading without the typical broker can help you avoid hefty. However, you can take part in self-directed trading by using a broker-dealer platform. Stock trading without the typical broker can help you avoid hefty.