mirfix.ru

Learn

Which Bank Has The Best Interest Rate

Top 20 highest savings rates on the market for September · Calculate interest earnings on top savings accounts · The best high-yield savings accounts. best for our members. And as it turns out, our members interest when you bank with LMCU. Pay less for your personal banking. GREAT Low Mortgage Rates. TAB Bank offers a high-yield savings account with % APY—11 times the national average. You only need $ on deposit to earn this rate and there is no. Seeking a high-interest bank account? Learn more about the different HSBC accounts, their banking deposit rates including the minimum balance to open an. rate. The U.S. Prime Rate is not always the lowest, the best or the favored rate of interest. Banks use different methods to determine what is the. With the Bank of England's decision to cut interest rates on 01 August by %, we are considering how this might affect savings rates. We'll notify. has been writing about bank accounts since before the Great Recession. There is no minimum Direct Deposit amount required to qualify for the stated interest. Full service community bank with the best rates in Massachusetts. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Top 20 highest savings rates on the market for September · Calculate interest earnings on top savings accounts · The best high-yield savings accounts. best for our members. And as it turns out, our members interest when you bank with LMCU. Pay less for your personal banking. GREAT Low Mortgage Rates. TAB Bank offers a high-yield savings account with % APY—11 times the national average. You only need $ on deposit to earn this rate and there is no. Seeking a high-interest bank account? Learn more about the different HSBC accounts, their banking deposit rates including the minimum balance to open an. rate. The U.S. Prime Rate is not always the lowest, the best or the favored rate of interest. Banks use different methods to determine what is the. With the Bank of England's decision to cut interest rates on 01 August by %, we are considering how this might affect savings rates. We'll notify. has been writing about bank accounts since before the Great Recession. There is no minimum Direct Deposit amount required to qualify for the stated interest. Full service community bank with the best rates in Massachusetts. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area.

You have larger balances and want to earn up to our highest rates. Interest rates. Your rate grows with your balance. Find a branch to learn about rate. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. FDIC Insured Bank Deposit Rates (Effective 03/23/) ; 1, Less than $,, % ; 2, $,–$,, % ; 3, $,–$,, % ; 4. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. Which bank has the best savings account? What are the best savings account Once again, the best savings account interest rates can vary and fluctuate based on. Among scheduled public sector banks, the Central Bank of India offers the highest fixed deposit interest rates of up to % p.a. on a tenure of days. What bank has the best online banking? comments. r Best Bank Interest Rates · Best Business Savings Accounts · Best Banks. Max helps you sweep your excess cash to FDIC-insured online savings accounts that offer higher rates than traditional brick-and-mortar banks or money market. Earn our best interest rates on your savings while keeping your money liquid and available It offers competitive interest rates and no monthly. Bank account interest rates increase your funds with a steady return. Find out today's CD, checking and savings account rates from Bank of America. Best Savings Accounts – September · Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings. The balance. best interest rates I can find.” MF, Chicago, IL. “Evergreen Bank has been an amazing partner in the expansion of our family run business. Their commercial. Your rate is good for 30 days, so you'll have plenty of time to shop for that perfect vehicle. Interest rate discount. Bank of America customers may be eligible. High Yield CD. Best for: Earning a higher interest rate when you lock in your funds for a longer term. The current interest rate of % (% Annual Percentage Yield [APY]) is accurate as of September 4, for Market Monitor accounts opened with a minimum. If you are interested in Citi's banking account relationship offers, please contact your Mortgage Representative to discuss which offer is best for you. Best High-Yield Savings Accounts of September Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate. When is the Best Time to Buy a Car in ? Timing can be an important How does the High Yield Savings interest rate work? You'll start earning.

Day Trader Book

Day Trading For Dummies book cover. Day Trading For Dummies. Author: Ann C. Logue · Buy on Amazon. Overview. Conquer the markets and become a successful day. Must-Read Trading Books for All Traders · Market Wizards · The New Market Wizards · Trade Your Way to Financial Freedom · Way of the Turtle: The Secret Methods that. 1. Beginner's Guide to Day Trading Online by Toni Turner · 2. How to Day Trade for a Living by Andrew Aziz · 3. Mastering the Trade by John Carter · 4. How to. Below is a list of all the resources I've personally been using on my journey towards becoming a full-time day trader. The book covers technical analysis, which is exactly how I trade the stock and crypto markets, and the fundamentals of trading so that you can have a. Really excited to officially announce my new book, Day Trading Attention: How to Actually Build Brand and Sales in the New Social Media World. This is a. Best Day Trading Books for Advanced Day Traders · Advanced Techniques in Day Trading by Andrew Aziz · Mastering the Trade by John Carter · High Probability. You picked up this book because you're serious about becoming a suc - cessful day trader. And, by reading this book, that's exactly what you'll learn how to do. How to Day Trade: The Plain Truth is pages of brutal honesty about day trading, including who's suited for it and who shouldn't even try. Day Trading For Dummies book cover. Day Trading For Dummies. Author: Ann C. Logue · Buy on Amazon. Overview. Conquer the markets and become a successful day. Must-Read Trading Books for All Traders · Market Wizards · The New Market Wizards · Trade Your Way to Financial Freedom · Way of the Turtle: The Secret Methods that. 1. Beginner's Guide to Day Trading Online by Toni Turner · 2. How to Day Trade for a Living by Andrew Aziz · 3. Mastering the Trade by John Carter · 4. How to. Below is a list of all the resources I've personally been using on my journey towards becoming a full-time day trader. The book covers technical analysis, which is exactly how I trade the stock and crypto markets, and the fundamentals of trading so that you can have a. Really excited to officially announce my new book, Day Trading Attention: How to Actually Build Brand and Sales in the New Social Media World. This is a. Best Day Trading Books for Advanced Day Traders · Advanced Techniques in Day Trading by Andrew Aziz · Mastering the Trade by John Carter · High Probability. You picked up this book because you're serious about becoming a suc - cessful day trader. And, by reading this book, that's exactly what you'll learn how to do. How to Day Trade: The Plain Truth is pages of brutal honesty about day trading, including who's suited for it and who shouldn't even try.

day trader. This book contains a comprehensive approach on how to get started as a day trader. We will cover important concepts such as: The difference. This book will teach you How to choose a direct access broker, as well as the necessary tools and platforms. * How to start day trading as a company. * How. Our trading books have the latest and best advice on how to trade all the key instruments effectively: from what and how to trade, through to managing risk. As the name suggests, day traders are market participants that attempt to extract a profit throughout the course of a single trading day or session. Popular Day Trading Books: How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology. Comprehensive coverage of the four major trading styles Evolution of a Trader explores the four trading styles that people use when learning to trade or. Buy a cheap copy of The Ultimate Day Trader: How to Achieve book by Jake Bernstein. Day trading is difficult. The path is fraught with risk. The S&P futures pit is the ultimate arena for traders. It is a place where trading titans make split-second decisions on huge amounts of money, and fortunes. Buy a cheap copy of The Ultimate Day Trader: How to Achieve book by Jake Bernstein. Day trading is difficult. The path is fraught with risk. “The three books in this series were written for people unfamiliar with the inner workings of the stock market, but will still curl the toes of professionals. They get to sell a book or a series of books. You, on the other hand, may be at risk of losing thousands, if not tens of thousands, of dollars! Trade Forex, Options, Stocks, and Futures to Become a SUCCESSFUL Day Trader day trading i totally recommend you to get yourself a copy of this book. Day trading is difficult. The path is fraught with risk. But a pot of gold awaits those who learn their lessons well. After four decades in the markets as a. The path is fraught with risk. But a pot of gold awaits those who learn their lessons well. With this book, readers will have the complete guide they need. Mark Douglas, a trader, personal trading coach, and industry consultant since , sends the message that “thinking strategy” will profoundly influence a. Master the art of day trading with these expert-recommended reads, selected from top financial publications and ranked by how often they're endorsed. Below is a list of all the resources I've personally been using on my journey towards becoming a full-time day trader. The purpose of this book is to help a potentially uninformed retail trader or inquisitive reader understand more about financial markets, and assist them in the. They help you understand the fast-moving financial markets. By learning about day trading books, trader education, trading psychology, and risk. How to Day Trade for a Living by Andrew Aziz provides a comprehensive guide to the world of day trading. It covers essential strategies, risk management, and.

Biggest Fortune 500 Company

The Fortune is an annual list compiled and published by Fortune magazine that ranks of the largest United States corporations by total revenue for. I turned down a gov job to take literally three times the salary at a pretty average paying company that has fantastic work-life balance. Gov. The Top 10 · 1. Walmart · 2. Amazon · 3. Apple · 4. UnitedHealth Group · 5. Berkshire Hathaway · 6. CVS Health · 7. Exxon Mobil · 8. Alphabet. 1 Reliance Industries, · 2 Indian Oil Corporation, · 3 LIC, · 4 ONGC, · 5 Bharat Petroleum Corporation, · 6 State Bank of India. Originating from the oil boom, ExxonMobil is the world's largest publicly-traded oil and gas company. Upholding values like safety, diversity, and ethics. The #Fortune, in its 70th year, ranks the biggest U.S. companies by revenue. In total, Fortune companies represent two-thirds of the U.S. GDP with. Apple remains the company with the best profits on the list for the eighth time in the past nine years. Texas holds onto its spot as home to the most Fortune. The Greater MSP region is a hub for headquarters. Home to more Fortune companies per capita than anywhere else in the world. The Greater MSP region is. The six Oklahoma headquartered companies made the in are ONEOK, Devon Energy, Williams, Chesapeake Energy, NGL Energy Partners and Continental. The Fortune is an annual list compiled and published by Fortune magazine that ranks of the largest United States corporations by total revenue for. I turned down a gov job to take literally three times the salary at a pretty average paying company that has fantastic work-life balance. Gov. The Top 10 · 1. Walmart · 2. Amazon · 3. Apple · 4. UnitedHealth Group · 5. Berkshire Hathaway · 6. CVS Health · 7. Exxon Mobil · 8. Alphabet. 1 Reliance Industries, · 2 Indian Oil Corporation, · 3 LIC, · 4 ONGC, · 5 Bharat Petroleum Corporation, · 6 State Bank of India. Originating from the oil boom, ExxonMobil is the world's largest publicly-traded oil and gas company. Upholding values like safety, diversity, and ethics. The #Fortune, in its 70th year, ranks the biggest U.S. companies by revenue. In total, Fortune companies represent two-thirds of the U.S. GDP with. Apple remains the company with the best profits on the list for the eighth time in the past nine years. Texas holds onto its spot as home to the most Fortune. The Greater MSP region is a hub for headquarters. Home to more Fortune companies per capita than anywhere else in the world. The Greater MSP region is. The six Oklahoma headquartered companies made the in are ONEOK, Devon Energy, Williams, Chesapeake Energy, NGL Energy Partners and Continental.

This list was first published in the May edition of Fortune and was based on the company revenue figures. That year the top companies were General Motors. Best Companies · Fortune · Global · Fortune Europe · Most Powerful Women · Future 50 · World's Most Admired Companies · See All Rankings. An annual list put together by FORTUNE Magazine of the largest companies. This list uses the most recent figures for revenue and includes both public and. Cisco has its offices in various parts and regions across the globe and is ranked 4th in the Fortune Magazine's list of best companies to work for. The. FORTUNE Magazine's annual ranking of the world's largest companies. Company Name, Revenues ($b), Profits ($b). 1, Royal Dutch Shell, , 2, Wal. Originating from the oil boom, ExxonMobil is the world's largest publicly-traded oil and gas company. Upholding values like safety, diversity, and ethics. 2, JPMorgan Chase & Co. A multinational banking corporation | World's largest public company ; 3, MetLife, Inc. Insurance and Financial Service Provider ; 4. Top Fortune Companies. Walmart · Amazon; Apple; CVS Health · UnitedHealth Group · Berkshire Hathaway · McKesson · AmerisourceBergen · Alphabet (Google). Listed below are the Fortune companies headquartered in Connecticut, but scroll down to see a few more examples of the top employers in each of our key. Company Matches ; 4, General Electric, 2, ; 5, Esmark, 2, ; 6, Chrysler, 2, ; 7, Armour, 2, Some of the biggest gains in rank include Albemarle, moving up 81 spots, Ingersoll Rand, moving up 64 spots, and Curtiss-Wright, moving up 56 spots. WHY. Atlanta Fortune Companies · # The Home Depot · # United Parcel Service (UPS) · # Delta Air Lines Inc. · # The Coca-Cola Company · # The Southern. The Dallas-Fort Worth region has been a magnet for corporate headquarters and major company operations, attracting Fortune company headquarters as of. No. NextEra. The utilities, gas and electric company in Juno Beach is “the largest electric utility holding company by market capitalization.”. From Fortune companies to fast-growing startups and hundreds of thousands of small businesses, companies of all sizes are driving economic opportunity. Fortune Best Companies to Work For® ; 6, Wegmans Food Markets, Inc. Rochester, NY, US ; 7, Accenture, n/a (below state is also NA), AL, US ; 8, Marriott. Walmart! The retail giant has claimed the top spot multiple times over the past decade, thanks to its impressive revenue growth and global dominance in the. Fortune Ranks America's Biggest Companies W.R. Berkley has been ranked # among Fortune's biggest companies! In total, Fortune companies. The #Fortune, in its 70th year, ranks the biggest U.S. companies by revenue. In total, Fortune companies represent two-thirds of the U.S. GDP with.

Accounts That Earn Compound Interest

Compound interest is essentially interest earned on top of interest. When it Investments Fixed Income Financial Planning. The information provided. How interest is calculated can greatly affect your savings. The more often interest is compounded, or added to your account, the more you earn. This. A compound interest account is any account that pays you interest on your principal and interest, and not simply on your original deposit. Such an account might. Compound interest is the interest on earned on your interest. This means that you earn a percentage on top of both what you put in as well as the interest you. Common Compounding Interest-Earning Accounts · Savings Accounts · Money Market Accounts · Certificates of Deposit (CDs). The key is compounding interest. Text, Compounding interest. That means you earn interest on the money you save and on the interest you already earned. When interest is compounded it means that you earn interest on your initial deposit, any additional deposits that you've made, and any interest that you have. 1. CDs · 2. High Yield Savings Accounts · 3. Rental Homes · 4. Bonds · 5. Stocks · 6. Treasury Securities · 7. REITs. Compound interest is interest earned on both the initial deposit you make in an account and the interest the account has already accumulated—also known as “. Compound interest is essentially interest earned on top of interest. When it Investments Fixed Income Financial Planning. The information provided. How interest is calculated can greatly affect your savings. The more often interest is compounded, or added to your account, the more you earn. This. A compound interest account is any account that pays you interest on your principal and interest, and not simply on your original deposit. Such an account might. Compound interest is the interest on earned on your interest. This means that you earn a percentage on top of both what you put in as well as the interest you. Common Compounding Interest-Earning Accounts · Savings Accounts · Money Market Accounts · Certificates of Deposit (CDs). The key is compounding interest. Text, Compounding interest. That means you earn interest on the money you save and on the interest you already earned. When interest is compounded it means that you earn interest on your initial deposit, any additional deposits that you've made, and any interest that you have. 1. CDs · 2. High Yield Savings Accounts · 3. Rental Homes · 4. Bonds · 5. Stocks · 6. Treasury Securities · 7. REITs. Compound interest is interest earned on both the initial deposit you make in an account and the interest the account has already accumulated—also known as “.

Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month. Compound interest accounts are any bank, financial institution, or investment accounts that let you earn compound interest. Some of the most common compound. Savings account interest rates. A variety of ways to earn interest on your money. Compound interest is interest accumulated from a principal sum and previously accumulated interest. It is the result of reinvesting or retaining interest. A compound interest account pays interest on the account's principal balance and any interest it had previously accrued. We have approx $, in cash sitting in checking accounts, ~$, sitting in managed ks, and another $50, in the under. Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously. This means, not only will you earn money on the principal amount in your account, but you will also earn interest on the accrued interest you've already earned. Compound interest happens when the interest you earn on your savings begins earning interest on itself. Learn how compound interest can increase your. It's interest that is paid on your original savings deposit – plus any interest you've already earned from past years. Unlike simple interest, compound interest lets your returns earn returns of their own. Money invested in the stock market and in savings accounts may benefit. In other words, compound interest involves earning, or owing, interest on your interest. The power of compounding helps a sum of money grow faster than if just. Compound interest is the interest you earn on your original money and on the interest that keeps accumulating. Compound interest allows your savings to grow. With investing, you don't earn interest. Instead, you're aiming to get a return on the money you invest. The effect of compounding over time means you could get. There are many compound interest accounts—most fall into one of two categories: deposit accounts or investment accounts. Both offer the potential for earning. Compound interest refers to the addition of earned interest to the principal balance of your account. The original sum of money invested, or the amount borrowed or still owing on a loan. For example, if you have a savings account, you'll earn interest on your. Compound returns, or compounding, happens when you earn returns, or profits investment gains—meaning you earn profits on top of your earlier profits. Compound interest builds on the principal balance plus accrued interest. If you have $1, at a 2% interest rate compounded annually, you'll earn $20 interest. Compounding interest: Interest Rate vs. APY Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to.

How Do I Get Collections Removed After Paying

Have a Professional Remove Paid Debt From Your Collection Account When or if you have reached your end with the hassle of having the paid collection account. Paying Collections · 1. Verify the Debt is Yours · 2. Check the Statute of Limitations · 3. Calculate the Amount You Can Afford to Pay · 4. Contact the Collection. You can request a goodwill deletion from a collection agency or the original lender if you've already paid the account in full. Essentially, you'll use your. A consumer may seek to have a default judgment vacated (removed) by making a request to the court after the default judgment is entered. Defaulting on a debt . However, if you pay by personal check, the collection agency will only post payment to your account once the check has cleared. after payment and how long. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. Get written confirmation from the creditor and the collector. The debt collector's confirmation should say that it will acknowledge the debt as paid in full. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. The best scenario is a Pay For Delete, whereby you make an agreement with the creditor or collection agency to remove/withdraw the item upon. Have a Professional Remove Paid Debt From Your Collection Account When or if you have reached your end with the hassle of having the paid collection account. Paying Collections · 1. Verify the Debt is Yours · 2. Check the Statute of Limitations · 3. Calculate the Amount You Can Afford to Pay · 4. Contact the Collection. You can request a goodwill deletion from a collection agency or the original lender if you've already paid the account in full. Essentially, you'll use your. A consumer may seek to have a default judgment vacated (removed) by making a request to the court after the default judgment is entered. Defaulting on a debt . However, if you pay by personal check, the collection agency will only post payment to your account once the check has cleared. after payment and how long. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. Get written confirmation from the creditor and the collector. The debt collector's confirmation should say that it will acknowledge the debt as paid in full. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. The best scenario is a Pay For Delete, whereby you make an agreement with the creditor or collection agency to remove/withdraw the item upon.

To verify your employment; · To get your location information; · To garnish your wages (that is, taking payment from your paycheck), but only after it sued you. Either the original creditor or the collection agency may report the account in collections to a credit bureau. The account will be marked on your credit report. Paying Collections · 1. Verify the Debt is Yours · 2. Check the Statute of Limitations · 3. Calculate the Amount You Can Afford to Pay · 4. Contact the Collection. With a pay-for-delete agreement, you agree to pay all or a portion of your outstanding debt in exchange for the creditor removing the charge-off from your. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. Remember, it is to the creditor's advantage to avoid bringing in a debt collection agency. However, if it begins to look as if you will not be able to pay the. A few years ago, I missed a month's payment with 2 credit card companies. This is also hurting my score. Should I write a letter to them asking them to remove. Pay-for-delete is an arrangement between a debtor and a debt collector. The debtor agrees to settle their debt, and in exchange, the debt collector commits to. Since buying a home is a big (and exciting!) With exceptions, your lender may require you to pay off any collections and charge-offs on your credit report. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. When a credit bureau removes a negative item from your credit report (at the request of a collection agency or otherwise), there's a chance your credit score. Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt. When a credit bureau removes a negative item from your credit report (at the request of a collection agency or otherwise), there's a chance your credit score. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. Do you pay your bills on time? If you have a credit card or a loan from a After six to nine months of this, check your credit report again. You can. To ask for pay for delete, you'll need to send a letter to the creditor or debt collection agency. A pay for delete letter should include: Your name and address. When you settle an account, you pay off a debt for less than what you owe. Usually, this occurs after you've been behind on your payments for some time. A debt. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. According to most credit scoring models, paying off a collection account doesn't stop it from having an effect on your credit. You'll usually have to wait until. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily.

What Are The Highest Paying Cds Right Now

Unlike regular savings accounts, most CDs have fixed rates, so you can lock in a higher rate while it lasts. Here's a look at current CD rates at some online. Certificates of Deposit (CDs) ; 18 Months, %, % ; 24 Months, %, % ; 30 Months, %, % ; 36 Months, %, %. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. But, rates fluctuate every year. Find the best CD accounts to reach your savings goals right now pay attention to when picking the right CD account. With a 6-month Regions Relationship CD rate starting at % APY and a month Regions Relationship CD rate starting at % APY, now is the time for you to. Right now, enjoy the flexibility of a shorter term with our 4-month Standard CD, featuring a great rate of % APY! Most of our CDs can be opened online. The highest paying CD rate right now is available at California Coast Credit Union. It has 5-month celebration certificate paying % APY, but this CD. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum. Unlike regular savings accounts, most CDs have fixed rates, so you can lock in a higher rate while it lasts. Here's a look at current CD rates at some online. Certificates of Deposit (CDs) ; 18 Months, %, % ; 24 Months, %, % ; 30 Months, %, % ; 36 Months, %, %. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. But, rates fluctuate every year. Find the best CD accounts to reach your savings goals right now pay attention to when picking the right CD account. With a 6-month Regions Relationship CD rate starting at % APY and a month Regions Relationship CD rate starting at % APY, now is the time for you to. Right now, enjoy the flexibility of a shorter term with our 4-month Standard CD, featuring a great rate of % APY! Most of our CDs can be opened online. The highest paying CD rate right now is available at California Coast Credit Union. It has 5-month celebration certificate paying % APY, but this CD. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum.

Who has the highest month CD rate? Navy Federal Credit Union offers % APY for 12 months. What is the highest-paying CD rate right now? Financial. First National Bank of America offers an APY of % for its year certificate. That makes it the best CD for this term length. paying for a wedding or buying a new car. Low risk. Park cash you don't plan to use right away in a low-risk investment while avoiding high market risk. Who has the highest CD interest rate right now? While the best CD rates frequently change, the highest-paying CDs are mostly from credit unions and online banks. The highest 2-year CD rate today is % from Bask Bank. Best 3-year CD rates. The highest 3-year CD rate today is % from MYSB Direct. Choose the level of commitment that's right for your CD savings ; 18 Months, %, $ ; 24 Months, %, $ ; 30 Months, %, $ ; 36 Months, %, $ There's Still Time to Earn Over 5% APY With These Top CD Rates ; BMO Alto · APY: /5. Minimum deposit and fees: /5. Customer service: /5 · % · %. Because they offer some of the highest saving rates on the market, jumbo CD accounts are a good option for individuals who want to earn a guaranteed rate of. Find out all about CDs, different types of CDs, how CDs compare to savings accounts, and the top CD rates available on Raisin — all FDIC or NCUA insured. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. Sallie Mae offers the best range of CD rates in , according to our exhaustive analysis of hundreds of banks. It earned the top rating of stars. Best 3-Year CD Account: Synchrony. Synchrony, an online- and mobile-only bank, offers one of the best three-year CD terms in the market in the form of a high. Quontic Bank has some of the best rates available on CDs with terms under two years. The standout is the one-year CD, which offers an even higher APY than CIT. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. Who has the highest month CD rate? Navy Federal Credit Union offers % APY for 12 months. What is the highest-paying CD rate right now? Financial. higher for CDs if you shop around. I have a high yield savings account that is earning a little over right now. Upvote 2. Downvote Award. CDs generally pay a fixed rate of interest based on the current Now you can browse the highest yielding CDs from the many banks available through Schwab CD. The Bank may limit the amount you may deposit in this product to an aggregate of $ million. 3. You may pay an early withdrawal penalty or a Regulation D. Open online and take advantage of our Digital Rate CDs and rest assured you are earning our best rates available Digital Rate CDs Are Now Available.

What Does One Share Of Apple Stock Cost

:max_bytes(150000):strip_icc()/dotdash-history-apple-stock-increases-v2-aa5cf47fb0ae487dba639a503aee0902.jpg)

Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Heres What Ivan Feinseth Expects - mirfix.ruordingly, Feinseth rates AAPL shares as a Strong Buy and raises his price target from $ to $ This. On June 21, with Apple's stock price at $, Apple issued two shares to investors at $ Five years later, with Apple stock price at an ever-higher. Apple Inc. is one of the very few companies that had successfully sensationalised the American stock market since its launch. Stock, but So Does This Low-Cost Vanguard ETF. 41 minutes ago • The Motley Fool. Markets. Is Apple Stock a Buy Now? 1 hour ago • The Motley Fool. Markets. 1 Apple Park Way Cupertino, CA United States. Website. mirfix.ru Do Not Sell or Share My Personal Information TrademarksPrivacy Policy. 54 minutes ago. The price of a security measures the cost to purchase 1 share of a security. For a company, price can be multiplied by shares outstanding to find the market. Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Heres What Ivan Feinseth Expects - mirfix.ruordingly, Feinseth rates AAPL shares as a Strong Buy and raises his price target from $ to $ This. On June 21, with Apple's stock price at $, Apple issued two shares to investors at $ Five years later, with Apple stock price at an ever-higher. Apple Inc. is one of the very few companies that had successfully sensationalised the American stock market since its launch. Stock, but So Does This Low-Cost Vanguard ETF. 41 minutes ago • The Motley Fool. Markets. Is Apple Stock a Buy Now? 1 hour ago • The Motley Fool. Markets. 1 Apple Park Way Cupertino, CA United States. Website. mirfix.ru Do Not Sell or Share My Personal Information TrademarksPrivacy Policy. 54 minutes ago. The price of a security measures the cost to purchase 1 share of a security. For a company, price can be multiplied by shares outstanding to find the market. Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions.

Stock Quote: NASDAQ: AAPL · Day's Open · Closing Price · VolumeM · Intraday High · Intraday Low

Apple Inc. historical stock charts and prices, analyst ratings, financials FactSet (a) does not make any express or implied warranties of any kind. Share price; Price change. Pre-market & after-hours; Market open & close 1-year stock price forecast. AAPL Competitors. Facts Insights Learn. $ Market. Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion trip you up. Convert Apple Inc stocks or shares into any. We've gathered analysts' opinions on Apple Inc future price: according to them, AAPL price has a max estimate of USD and a min estimate of USD. AAPL | Complete Apple Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. PE Ratio: ; Above Low: +NaN% ; Below High: NaN% ; Business Description · Apple is among the largest companies in the world, with a broad portfolio of hardware. Number of shares outstanding as of September 15,,, According to Apple's latest financial reports and stock price the company's current number. The latest closing stock price for Apple as of September 05, is The all-time high Apple stock closing price was on July 16, The Apple. Apple ; Market Cap. $T ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. Apple Inc. AAPL (U.S.: Nasdaq). AT CLOSE PM EDT 09/06/ $USD; %. Volume48,, AFTER HOURS PM EDT 09/06/ Looking to buy Apple Stock? View today's AAPL stock price, trade commission-free, and discuss AAPL stock updates with the investor community. Apple Share Price Live Today:Get the Live stock price of AAPL Inc., and quote, performance, latest news to help you with stock trading and investing. So Apple has b shares outstanding, at a current price of $, gives a market capitalization of $b. This is how much money the market. Apple Inc. (AAPL) ; Dec 5, , , ; Dec 4, , , ; Dec 1, , , ; Nov 30, , , Stock · How can I get the current Apple stock price? · Does Apple pay a cash dividend? · Does Apple have a share repurchase program? · Can I purchase stock directly. Current $ ; Target $ ; Technicals Summary. Sell. Neutral. Buy. Apple, Inc. is currently in a favorable trading position (BUY) according to technical. How Much Would Apple Stock Be Worth If It Never Split? If Apple never split its stock, a single share would have been worth around $1, as of The. Fundamentals Apple Inc. ; Dividend yield in %, ; P/E Ratio, ; Profit per share, ; Number of shares, bn ; Market capitalization, 3, bn. Over the past 20 years Apple stock generated an annualized total return (price change plus dividends) of %. For those wondering if Apple stock is a buy at. The lucky recipient gets the cool stock certificate and becomes a real shareholder of the company entitled to annual reports, declared dividends, invites to.

Privacy Setting On Facebook

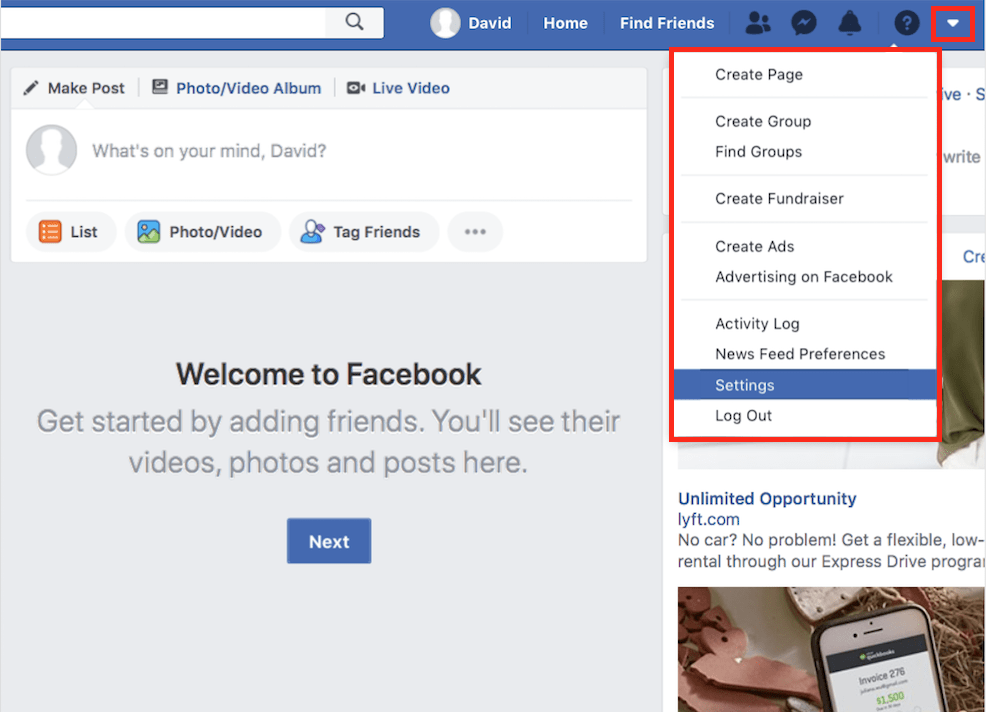

1. Tap in the top right of Facebook. 2. Scroll down and tap Settings. 3. Scroll down to Audience and visibility section and tap the option that you want to. Over the past couple of years, the default privacy settings for a Facebook user's personal information have become more and more permissive. They've also. Your privacy settings let you manage basic privacy preferences. For other stuff you share on Facebook, you can choose your audience right when you post. Facebook privacy settings on iPhone: Medium level · 1. Tap the menu icon in the lower right corner of the app; · 2. Tap the cogwheel in the upper right corner; · 3. Adjust Privacy Settings: Setting every option to "Only Me" will make your Facebook profile completely private. You can also use the Privacy. UPDATE: Facebook deleted this nasty setting on April 29, · 1. For complete browsing privacy, set your Web browser not to accept cookies This isn't a. 1. Tap in the top right of Facebook. ; 2. Scroll down and tap Settings & Privacy, then tap Settings. ; 3. Scroll down to Audience and visibility and tap the. You can find these privacy settings on the Privacy & safety tab of your Messenger account. 1. Open your Messenger mobile app. 2. Tap, then tap. 3. Your privacy settings page has a group of general controls for your Facebook account. 1. Tap in the top right of Facebook. 2. Scroll down and tap Settings. 3. Scroll down to Audience and visibility section and tap the option that you want to. Over the past couple of years, the default privacy settings for a Facebook user's personal information have become more and more permissive. They've also. Your privacy settings let you manage basic privacy preferences. For other stuff you share on Facebook, you can choose your audience right when you post. Facebook privacy settings on iPhone: Medium level · 1. Tap the menu icon in the lower right corner of the app; · 2. Tap the cogwheel in the upper right corner; · 3. Adjust Privacy Settings: Setting every option to "Only Me" will make your Facebook profile completely private. You can also use the Privacy. UPDATE: Facebook deleted this nasty setting on April 29, · 1. For complete browsing privacy, set your Web browser not to accept cookies This isn't a. 1. Tap in the top right of Facebook. ; 2. Scroll down and tap Settings & Privacy, then tap Settings. ; 3. Scroll down to Audience and visibility and tap the. You can find these privacy settings on the Privacy & safety tab of your Messenger account. 1. Open your Messenger mobile app. 2. Tap, then tap. 3. Your privacy settings page has a group of general controls for your Facebook account.

Learn how to change your privacy settings on Facebook using Windows. These steps adjust your privacy and security settings to Medium level protection. For the first three options, you can restrict who can find you by changing the settings to “friends” or “friends of friends” instead of leaving it public. By. Over the past couple of years, the default privacy settings for a Facebook user's personal information have become more and more permissive. They've also. To avoid having to go through each post individually and check the privacy settings, use the “Limit Old Posts” option. This will change the privacy of all past. A guide to every privacy setting you should change now. We have gone through the settings for the most popular (and problematic) services to give you. In this article, we're going to look at why photo privacy matters, then explain how you can protect your images from the eyes of strangers. This guide provides users with the steps needed to access and change privacy and security settings, as well as instructions on how to view the user data. You have two privacy settings: Public or Private. Public means that anyone can see who is in the group and what is posted in the group, even if they are not in. 1. Click the small arrow in the top right of Facebook · 2. Select Settings & privacy, then click Settings · 3. In the left column, click Privacy · 4. Click "Edit". The fastest way to change your privacy settings is to use privacy shortcuts. To access privacy shortcuts, first click the Help Center button on the toolbar. Your privacy settings page has a group of general controls for your Facebook account. We'll do this with a tour through your privacy settings (Account > Privacy Settings). Let's start with the big section in the middle: "sharing on Facebook.". Adjust Privacy Settings: Setting every option to "Only Me" will make your Facebook profile completely private. You can also use the Privacy. To avoid having to go through each post individually and check the privacy settings, use the “Limit Old Posts” option. This will change the privacy of all past. Suggested Privacy and Security Settings: Account Settings | General | Email Account Settings | Security Privacy Settings: How you connect – set as restrictive. Time to set up the privacy of applications and websites that are used within. FaceBook. To begin, click on EDIT YOUR. SETTINGS. Page 5. You may want to. From your Home or Timeline page, just open the menu at the top of the page and select Privacy Settings. Protect basic information. To restrict access to parts. Managing privacy settings for posting on a Facebook group. 1. Go to your Group where you plan to do your live stream. 2. Scroll down the menu on the left until. Understanding basic privacy settings Whenever you share something on Facebook, you can choose who you'll share with. In the infographic below, you can see the.

Who Elects The Board Of Directors

It is the role of the board of directors to hire the CEO or general manager of the business and assess the overall direction and strategy of the business. The Members of the. Board shall be appointed by the President, with the advice and consent of the Senate. Page 3. Approved April 29, (b) The Secretary of. A public company's board of directors is chosen by shareholders, and its primary job is to look out for shareholders' interests. Members of the board are elected and appointed county officials from active member counties or designated officials and are nominated at the Annual. A board member is elected, designated or appointed to be the director of a society. We refer to “board members” in this document, but the Societies Act. The details about the election process are constituted in the bylaws of the cooperative. Who can be elected to the board of directors? 5) Can only members be. A board of directors election is an election where voting members elect new/returning board members for leadership positions in their organization. Or the person who takes the initial step of incorporating the business (the "incorporator") selects them. Shareholders typically elect directors at annual. The board of directors of a corporation is typically elected by the shareholders and is responsible for ensuring that management is doing its job properly. It is the role of the board of directors to hire the CEO or general manager of the business and assess the overall direction and strategy of the business. The Members of the. Board shall be appointed by the President, with the advice and consent of the Senate. Page 3. Approved April 29, (b) The Secretary of. A public company's board of directors is chosen by shareholders, and its primary job is to look out for shareholders' interests. Members of the board are elected and appointed county officials from active member counties or designated officials and are nominated at the Annual. A board member is elected, designated or appointed to be the director of a society. We refer to “board members” in this document, but the Societies Act. The details about the election process are constituted in the bylaws of the cooperative. Who can be elected to the board of directors? 5) Can only members be. A board of directors election is an election where voting members elect new/returning board members for leadership positions in their organization. Or the person who takes the initial step of incorporating the business (the "incorporator") selects them. Shareholders typically elect directors at annual. The board of directors of a corporation is typically elected by the shareholders and is responsible for ensuring that management is doing its job properly.

Directors of a nonprofit corporation, other than those constituting the first board of directors, shall be elected by the members. Directors, other than those constituting the first board, shall be elected by the voting members, unless some other method is expressly provided in the articles. A board of directors is a panel of people elected to represent shareholders. Every public company is required to install a board of directors. (1 & 2) Boards of directors are elected by the shareholders. They exist to oversee the operations of the company, Mainly, they hire the. The board of directors is usually elected by the shareholders of the corporation. The shareholders will vote for the candidates that they believe will best. Or the person who takes the initial step of incorporating the business (the "incorporator") selects them. Shareholders typically elect directors at annual. It does not matter that a director is also an officer--it does not give him/her an extra vote. If the board consists of five directors, it has one for each. Upon election to the board, members are expected to have a solid understanding of the association's mission, strategic plan goals and objectives. The board of directors is elected by the shareholders of the corporation. The chair is elected from the board of directors. Inside directors: These. In general, shareholders will appoint themselves as directors (as is the case for small companies) or will vote on a slate of nominees proposed by any. Corporate officers are elected by the board of directors. Their job is to manage the daily activities of the corporation. Directors are most often directly elected by the membership. The election takes place at the Annual General Meeting and is often supported by postal vote. The authority of the directors commences immediately after the election and continues until their successors are elected and qualified, unless sooner removed in. the board of directors by fixing a minimum and maximum number of directors. (4) Directors shall be elected at the first annual shareholders' meeting and at. While shareholders elect directors, the nominating committee decides which candidates are put forward for nomination. Directors' terms should be staggered to. Members of the Board, appointed through a nominations and elections process, assume office at the close of the House of Delegates at which they were elected. A. Until election by members, the first board shall appoint directors to fill any vacancies. 2. Generally. a. Directors shall be elected for the term, at the time. If the company is publicly traded, shareholders usually elect board members. This can occur at a public meeting, by allowing electors to vote by mail or using a. Directors of both public and private companies are elected according to the charter and bylaws of the company. Depending on the state where the.

Can You Open A Bank Account With Temporary Id

You can even use your IDNYC card to open a bank account at certain financial institutions. You can use your IDNYC card as proof of identity when you. Note: If you can't provide at least one piece of identification from the Acceptable Identification List above, you can provide 2 identification documents from. It depends on the bank's policy and the type of temporary ID you have. In general, banks require government-issued photo identification to open a bank account. Bank statement;; Government check;; Paycheck;; Other government document; or If you do not have a photo ID because of a religious objection to being. Two forms of identification (ID) are needed to open at a branch Proof of address is required: If neither primary nor secondary ID contains your physical. Fortunately, a non-US citizen can open a bank account in the US. However, they may need to come up with different identification than US citizens who are. 1. Valid form of identification. Your bank will need to confirm your identity. Because of this, they'll want at least one form of identification that is valid. Acceptable Primary Sources of Identification · US driver's license (in or out-of-state) · US passport · Firearms identification card · US Armed Forces. Things to know before you go. • Please bring a primary and secondary form of ID. • All documents must be original (we cannot accept copies or screenshots). You can even use your IDNYC card to open a bank account at certain financial institutions. You can use your IDNYC card as proof of identity when you. Note: If you can't provide at least one piece of identification from the Acceptable Identification List above, you can provide 2 identification documents from. It depends on the bank's policy and the type of temporary ID you have. In general, banks require government-issued photo identification to open a bank account. Bank statement;; Government check;; Paycheck;; Other government document; or If you do not have a photo ID because of a religious objection to being. Two forms of identification (ID) are needed to open at a branch Proof of address is required: If neither primary nor secondary ID contains your physical. Fortunately, a non-US citizen can open a bank account in the US. However, they may need to come up with different identification than US citizens who are. 1. Valid form of identification. Your bank will need to confirm your identity. Because of this, they'll want at least one form of identification that is valid. Acceptable Primary Sources of Identification · US driver's license (in or out-of-state) · US passport · Firearms identification card · US Armed Forces. Things to know before you go. • Please bring a primary and secondary form of ID. • All documents must be original (we cannot accept copies or screenshots).

Note: If you are locked out of your mirfix.ru account and are working with an ID We can accept temporary driver's licenses and state IDs. Forms you. *Please note that we cannot accept the temporary Indiana driver's license and state ID account unless you have your old Indiana driver's license/ID with you. Or do you need to renew your current Kansas DL or ID card? Follow this Document requirements vary, we have included what you need for different situations. bank account number. Go to Online Services. If you are traveling in the U.S. and lose your license, ID or permit, complete a Duplicate Driver's License. Most banks request two forms of government issued ID. Financial institutions that require two forms of ID may want at least one of the IDs to be a photo ID. This additional step is to continue to keep your account secure. Scanning a government-issued ID. If you don't have the Capital One Mobile app or prefer not to. General Requirements. If you operate a motor vehicle on public roadways in Delaware, you are required to have a driver license and you must carry it with. Acceptable Primary Sources of Identification · US driver's license (in or out-of-state) · US passport · Firearms identification card · US Armed Forces. You will be issued a temporary paper ID. The card will be mailed to you identification to access medication, banking information and other services. An identification number is needed at most banks to open an account. You can use a Social Security Number (SSN). If you don't qualify for a social security. I want to open a new account. What type(s) of identification do I have to present to the bank? · Taxpayer identification number · Passport number and country of. Open a bank account. Apply for or receive federal benefits (Veterans Affairs Once you have a REAL ID DL/ID, you will be able to renew by mail or. Identification: You'll also need to provide a valid government-issued If you are trying to save for short-term goals such as a car, vacation, or. U.S. issued driver license; Acceptable secondary form of identification; Acceptable form of proof of address ; Foreign Passport with temporary Form I One valid form of primary identification, like a driver's license, valid passport, or government-issued ID with photo and signature. If applicable, a check or. These documents are known as KYC (Know Your Customer documents). KYC documents include: Green barcoded ID or a valid passport if you are a foreign national. Bank card (debit) with your name preprinted on it. Some banks will give you a card the same day you open an account. Online bill printouts. You can print out a. However, for noncitizens, proof of residence will not be available yet. So, what do they have to provide? An unexpired passport; Any government-issued ID card. These documents are known as KYC (Know Your Customer documents). KYC documents include: Green barcoded ID or a valid passport if you are a foreign national. If the name on your identity document differs from your current legal name, you account, investment account, credit card account, or loan/credit financing.