mirfix.ru

Community

Advertising Strategies List

You can focus on digital ad platforms, including Facebook, Twitter, LinkedIn, YouTube and Google AdWords. Or, you can choose more traditional advertising. 5 Types of ad campaigns · 1. Online advertising and digital marketing · 2. Broadcast advertising and video marketing · 3. Print advertising · 4. Holiday marketing. 10 Advertising Techniques for Advertisers and Brands · 1. Promotions and Rewards · 2. Use Statistics and Data · 3. Endorsements · 4. Repetition · 5. Ask the Right. Advertisers · How does Outbrain Amplify Work? Using a complex set of algorithms and Outbrain's Interest Graph©, our system pairs your content with readers who. Emotional Appeal · Promotional Advertising · Bandwagon Advertising · Facts and Statistics · Unfinished Ads · Weasel Words · Endorsements · Complementing the Customers. People, process, and physical evidence are extensions of the original Four Ps and are relevant to current trends in marketing. Any successful marketing strategy. What are the best online advertising strategies? PPC, CTV, remarketing, and more, offer some of the best ways to advertise online. Learn more now! The first strategy is Create a lots of Ads to “HOOK” your audience: If you try to create just one hook, it may last for a while and grab the. Creating strategic marketing strategies starts with defining what is product marketing for your niche, understanding where you are now, identifying key areas of. You can focus on digital ad platforms, including Facebook, Twitter, LinkedIn, YouTube and Google AdWords. Or, you can choose more traditional advertising. 5 Types of ad campaigns · 1. Online advertising and digital marketing · 2. Broadcast advertising and video marketing · 3. Print advertising · 4. Holiday marketing. 10 Advertising Techniques for Advertisers and Brands · 1. Promotions and Rewards · 2. Use Statistics and Data · 3. Endorsements · 4. Repetition · 5. Ask the Right. Advertisers · How does Outbrain Amplify Work? Using a complex set of algorithms and Outbrain's Interest Graph©, our system pairs your content with readers who. Emotional Appeal · Promotional Advertising · Bandwagon Advertising · Facts and Statistics · Unfinished Ads · Weasel Words · Endorsements · Complementing the Customers. People, process, and physical evidence are extensions of the original Four Ps and are relevant to current trends in marketing. Any successful marketing strategy. What are the best online advertising strategies? PPC, CTV, remarketing, and more, offer some of the best ways to advertise online. Learn more now! The first strategy is Create a lots of Ads to “HOOK” your audience: If you try to create just one hook, it may last for a while and grab the. Creating strategic marketing strategies starts with defining what is product marketing for your niche, understanding where you are now, identifying key areas of.

Some great advertising strategies include using social media platforms to advertise, using influencers to advertise your product, and using. The best marketing tactics definition is simply this: any action that marketers take to accomplish their big-picture goals of acquiring and retaining. 32 advertising tactics · 1. Print ads · 2. Digital ads · 3. Social media ads · 4. Television ads · 5. Radio ads · 6. Email newsletters · 7. Direct mail · 8. Cold calls. 12 Examples of Advertising Strategies · 1. SEM · 2. Social Ads · 3. Amazon Advertising · 4. Email Marketing · 5. Native Advertising · 6. Influencer Marketing. Contests and Sweepstakes. Another way to attract attention and bring in new customers is by running a contest or sweepstakes. This strategy can be used in. What are the best online advertising strategies? PPC, CTV, remarketing, and more, offer some of the best ways to advertise online. Learn more now! strategies—5 ways brands and agencies can properly use the tech. 6 days List Awards Winners · Publishing Partner: · Floating phone screens with security. Unlike a method such as PPC, content marketing is a long-term strategy. Over time, marketers build up a library of content (text, video, podcasts, etc.) that. 4 Types Of Marketing Plans And Strategies · 1. Market Penetration Strategy. When a firm focuses on selling its current products to existing customers, it is. Digital advertising can be a very effective way of marketing education services, which is part of the reason why worldwide digital advertising spending is. An effective marketing strategy should address all channels your brand plans to utilize to reach audiences. That could include in-store channels as well as. 19 strategies for increasing your Audience reach and improving conversions · 3. Target Similar segments · 4. Use auto-targeting · 5. Use dynamic remarketing · 6. Re. There are two major types of advertising strategies: institutional and product. The former is used to promote a brand while the latter is used to promote a. A Top-of-the-Funnel Campaign to Build Awareness: Want to reach new audiences? Upload a list of demographic information about your current families to create a. Media: Advertising. Conventional Persuasive Strategies for Advertisement. 1. Famous Person Testimonial – a product is endorsed by a well-known person, such as. Advertising is the practice and techniques employed to bring attention to a product or service. Advertising aims to present a product or service in terms of. Get more leads and sales - paid ad campaigns provide one of the easiest ways to reach your target audience at various points in the customer journey. They are. Marketing tools · Product: variety, quality, design, features, brand name, packaging, services · Price: list price, discounts, allowance, payment period, credit. Some tactics stand the test of time. These 14 types of traditional marketing build the foundation for many companies' strategies. 1. Brand Marketing. Brand. Choose a sign-up offer to jumpstart your first campaign · OFFER A. $ in Ads credit. $ in Ads credit. Spend $ with Google Ads in the first 60 days to.

How To Buy Bonds In Stock Market

You can buy bonds in a similar way to how you might buy stocks. If you have an account at a broker, you can log in and navigate to the bond trading platform. In the long run, stocks may provide you with a greater return on investment than securities like bonds can offer. Common stocks of major corporations are. There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bonds differ from stocks in that they aren't traded publicly. Investors must go through a broker to purchase most bonds, or they can buy US Treasury bonds. You can trade bonds online 24/5 if the underlying bond market is open. Trading hours are limited to the daylight hours in the region where liquidity in the. Companies issue corporate bonds to raise capital for a number of reasons, such as expanding operations, purchasing new equipment, building new facilities, or. Find everything you need to buy and sell bonds and other fixed-income investments that can help manage risk in your portfolio and give you predictable income. Some financial institutions will provide their clients with the service of transacting government securities. If, however, your financial institution doesn't. Bonds are an investment product where you agree to lend your money to a government or company at an agreed interest rate for a certain amount of time. In return. You can buy bonds in a similar way to how you might buy stocks. If you have an account at a broker, you can log in and navigate to the bond trading platform. In the long run, stocks may provide you with a greater return on investment than securities like bonds can offer. Common stocks of major corporations are. There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bonds differ from stocks in that they aren't traded publicly. Investors must go through a broker to purchase most bonds, or they can buy US Treasury bonds. You can trade bonds online 24/5 if the underlying bond market is open. Trading hours are limited to the daylight hours in the region where liquidity in the. Companies issue corporate bonds to raise capital for a number of reasons, such as expanding operations, purchasing new equipment, building new facilities, or. Find everything you need to buy and sell bonds and other fixed-income investments that can help manage risk in your portfolio and give you predictable income. Some financial institutions will provide their clients with the service of transacting government securities. If, however, your financial institution doesn't. Bonds are an investment product where you agree to lend your money to a government or company at an agreed interest rate for a certain amount of time. In return.

Bonds and bond funds can help diversify your portfolio. Bond prices fluctuate, although they tend to be less volatile than stocks. Some bonds, particularly. Purchasing individual bonds requires a brokerage account. Unlike stocks, there is no well-established public market where bonds are actively traded. Instead. A full range of investment choices. Find your preferred way to invest, whether you're interested in simple stock trades or advanced options and margin trading. Commodities are physical goods like gold, oil, or crops that people can invest in. They can be more volatile than stocks or bonds, which means their value can. You can buy corporate bonds on the primary market through a brokerage firm, bank, bond trader, or a broker. Some corporate bonds are traded on the over-the-. They can also help diversify a portfolio as they can serve as a ballast in times of market volatility. Why invest in fixed income securities? Investing in fixed. Bonds' steady income stream can help balance out equities during periods of market volatility. · Different types of bonds, including government bonds, municipal. A bond is a debt security, like an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. A well-diversified portfolio should include a mix of stocks, bonds and cash (the three major asset classes). How much of each you hold depends on your financial. But stocks are just one of many different asset classes investors have the opportunity to put their money into. Another common type of investment you might. All Treasury marketable securities require a minimum bid of $ You may bid in increments of $ up to a maximum of $10 million for a non-competitive bid. Individual bonds are less liquid assets than stocks, so they tend to require more careful consideration before buying. Getting started is as simple as opening. Bonds are loans you make to a government, government agency, or corporation, which they use to finance projects and other needs. The bond issuer agrees to. Buying Bonds · Through A Broker You can buy bonds through a broker, just like you can buy stocks and other investments. The bonds you buy are typically sold by. Individual bonds · Will you buy on the primary market or on the secondary market? · Will you buy Treasury bonds, corporate bonds, or some other type of bonds? We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. Bonds may be less risky than stocks, but theyre not risk-free. If your bond defaults, then youre losing out. How do you pick the right bond, then? By consulting. Bonds' steady income stream can help balance out equities during periods of market volatility. · Different types of bonds, including government bonds, municipal. Since ETFs are traded on the stock market exchange, your order will be filled and the shares in the bond fund added to your portfolio as soon as the trade is. 13 votes, 53 comments. I have no experience with bonds, but have been investing in stocks for a while. I'm looking to get some.

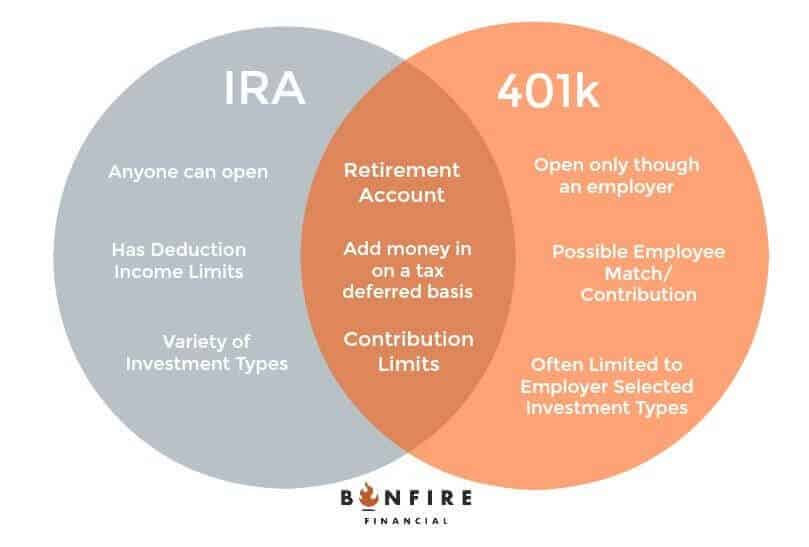

Can You Do Ira And 401k

Gather your most recent (k) and IRA statements. · Collect online rollover or transfer forms and contact information from your brokerage company or previous. And if you earn between $, and $, jointly, you can contribute to a Roth, but the amount is reduced. For single taxpayers, the income phaseout begins. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. If you already have a (k), you can still open an IRA and contribute to both accounts. But if you or your spouse (if you're married) are covered by a. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. Traditional IRAs are similar to (k) plans in that contributions you make can be deducted from your income. You can contribute to a (k) and an IRA in the same year. However, depending on your adjusted gross income (AGI), IRA contributions may not be tax-deductible. Many determined retirement savers contribute to both a (k) and an IRA. You can save up to the respective annual limit in each account, though tax benefits on. Depending on your circumstances, if you roll over your money from your old (k) to a new one, you'll be able to keep your retirement savings all in one place. Gather your most recent (k) and IRA statements. · Collect online rollover or transfer forms and contact information from your brokerage company or previous. And if you earn between $, and $, jointly, you can contribute to a Roth, but the amount is reduced. For single taxpayers, the income phaseout begins. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. If you already have a (k), you can still open an IRA and contribute to both accounts. But if you or your spouse (if you're married) are covered by a. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. Traditional IRAs are similar to (k) plans in that contributions you make can be deducted from your income. You can contribute to a (k) and an IRA in the same year. However, depending on your adjusted gross income (AGI), IRA contributions may not be tax-deductible. Many determined retirement savers contribute to both a (k) and an IRA. You can save up to the respective annual limit in each account, though tax benefits on. Depending on your circumstances, if you roll over your money from your old (k) to a new one, you'll be able to keep your retirement savings all in one place.

You have to make a contribution for the five-year time period to start. The problem is that not everyone is eligible to do so. The ins and outs. Yes. You can contribute to an IRA even if you or your jointly-filing spouse are covered by an employer-sponsored retirement plan, such as a (k). The good news is you don't have to choose between a Roth (k) and a Roth IRA — you can have both. If you receive a Roth (k) through your employer, consider. Do you have multiple Individual Retirement Accounts (IRAs)? You can consolidate IRAs you have at other institutions to your IRA at Wells Fargo. Learn how to. You can roll over your IRA into a qualified retirement plan (for example, a (k) plan), assuming the retirement plan has language allowing it to accept this. You can contribute to an IRA even if you, or your spouse, are already contributing the maximum to a (k), (b), , TSP or other retirement-savings plan. Learn how to rollover an existing (k) retirement plan from a former employer to a rollover IRA plan and consolidate your money. IRA and a (k)?. Yes, you can — but double check the rules to make sure you're optimizing your retirement savings. Updated Apr 16, · 1 min read. You can roll IRA funds into a (k), and there are several reasons to do so. Learn about the limitations and pitfalls before moving forward. Many people roll over their (k) savings when they change jobs or retire. However, numerous (k) plans allow employees to transfer funds to an IRA while. You can have a (k) and an IRA - they have separate contribution limits. You can make both Traditional and Roth contributions to a (k), but. The short answer is yes, it's possible to have a (k) or other employer-sponsored plan at work and also make contributions to an individual retirement plan. How do you choose between saving in a traditional retirement account and saving in a Roth? If you work for a large employer, you may be able to contribute to. You can make contributions for each year as late as the tax-filing deadline for that year's taxes. Contributions can be made to your traditional IRA for each. Whether your IRA contribution is tax-deductible depends on three factors: For , if you are covered by a retirement plan with your employer, your IRA. But what should you do with them? Rolling over your (k) to an IRA (Individual Retirement Account) is one way to go, but you should consider your options. You may choose to split your contributions between Roth and traditional (k)s, but your combined contributions can't exceed $22, ($30, if you're age If both a (k) plan and a SEP IRA are offered by the same business, business owners can contribute to both plans simultaneously, however contributions between. The short answer is yes, it's possible to have a (k) or other employer-sponsored plan at work and also make contributions to an individual retirement plan. Learn how to fill out your W-2, how to report freelance wages and other income-related questions. Retirement income. How do taxes change once you're retired?

Discover Home Equity Loan Payment

Wondering how to use your home loan? Call to learn about home loans with Discover Home Loans Home Equity Loan Rates · Mortgage Refinance Rates. Repayment of a home equity loan requires that the borrower make a monthly payment to the lender. That monthly payment includes both repayment of the loan. View your loan summary; View your tax and interest information; Make an online payment; And much more. Register. The estimated total pay range for a Home Equity Loan Officer at Discover is $83K–$K per year, which includes base salary and additional pay. The average. Not only can you get rates below 4%, but you'll also be able to secure a loan with no application fees, no origination fees, and no cash required at closing. Home Equity Line of Credit: Repayment options may vary based on credit qualifications. Choosing an interest-only repayment may cause your monthly payment to. Loan Amount Calculator. Estimate the amount you may be eligible to borrow with a home equity loan or mortgage refinance. Call to learn about home loans with Discover Home Loans Home Equity Loan Rates · Mortgage Refinance Rates. Popular Calculators. Rate & Payment. Need to make a payment? Check your Discover loan status? Reach out to customer service? We're here for you. Login to your account or contact us today! Wondering how to use your home loan? Call to learn about home loans with Discover Home Loans Home Equity Loan Rates · Mortgage Refinance Rates. Repayment of a home equity loan requires that the borrower make a monthly payment to the lender. That monthly payment includes both repayment of the loan. View your loan summary; View your tax and interest information; Make an online payment; And much more. Register. The estimated total pay range for a Home Equity Loan Officer at Discover is $83K–$K per year, which includes base salary and additional pay. The average. Not only can you get rates below 4%, but you'll also be able to secure a loan with no application fees, no origination fees, and no cash required at closing. Home Equity Line of Credit: Repayment options may vary based on credit qualifications. Choosing an interest-only repayment may cause your monthly payment to. Loan Amount Calculator. Estimate the amount you may be eligible to borrow with a home equity loan or mortgage refinance. Call to learn about home loans with Discover Home Loans Home Equity Loan Rates · Mortgage Refinance Rates. Popular Calculators. Rate & Payment. Need to make a payment? Check your Discover loan status? Reach out to customer service? We're here for you. Login to your account or contact us today!

Accessing your home's equity can pay for home renovation projects, debt, and more. low rates. Rates can be lower than other forms of borrowing like credit cards. Apply for a Home Equity Loan or Line of Credit at special rates. · Reduced rates starting as low as % (% APR) · Loan amounts from $5,$, The loan payments are added on top of your mortgage balance, which is why a home equity loan is often called a “second mortgage.” Use our home value estimator. Discover does NOT currently offer HELOCs. It's one of several big-name banks that have discontinued them in recent years, often in response to the pandemic. But. Rate & Payment Calculator · Debt Consolidation Calculator · Loan Amount Home Equity Loan Rates · Mortgage Refinance Rates · Rate & Payment Calculator. Perfect for larger expenses that require a one-time lump sum payment such as remodeling your home or consolidating debts into one easy payment. Discover Home Equity Loans allows borrowers to apply for home equity loans of up to $, The actual maximum loan amount will vary depending on the value of. Or, call Discover home loans at to contact a loan officer directly and apply over the phone. You also have the option of mailing, faxing, emailing. The estimated total pay range for a Home Equity Loan Officer at Discover is $83K–$K per year, which includes base salary and additional pay. The average. Discover Home Equity Loans allows borrowers to apply for home equity loans of up to $, The actual maximum loan amount will vary depending on the value of. Typically, home equity loans have a fixed interest rate, fixed term and fixed monthly payment. Interest on a home equity loan may be tax deductible under. What you can do with a Home Equity Loan from Discover · Achieve multiple goals · Erase expensive debts · Monthly interest payments adding up? · Access your account. Loan amounts from $35, to $, available in lump sum amounts with fixed monthly payments. · Fixed APRs from % APR for first liens and % APR for. We submitted an application for HEL through discover. We are in the “processing” stage. Has anyone had experience with how long this specific step takes? Your monthly payment depends on how much you borrow and on the current interest rate (based on interest accrued during the billing cycle). Rate Type, Variable. We submitted an application for HEL through discover. We are in the “processing” stage. Has anyone had experience with how long this specific step takes? Homeowners may be able to consolidate multiple high interest debts into a single monthly payment with a low, fixed rate using a home equity loan. Home equity line of credit. Looking for a convenient revolving source of funds, similar to a credit card? Our HELOC is an outstanding option. Borrow, repay and. Discover Cardmembers can apply for home equity loans and lines of credit online 24 hours a day, seven days a week at mirfix.ru or by. You Don't Want To Refinance. A Home Equity Loan is a second mortgage. · You Need A Lump Sum. And have paid down your mortgage enough to take cash out starting at.

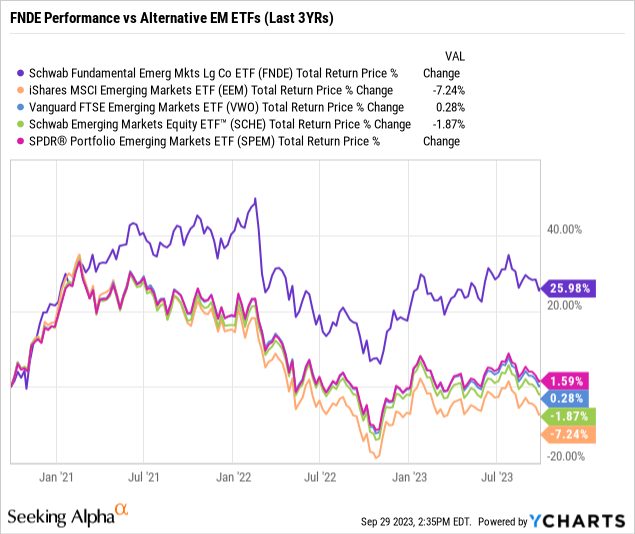

Fnde Etf

Explore FNDE for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Analyze Schwab Fundamental Emerging Markets Equity ETF (FNDE): check AUM and research returns, dividends, fund flows, and other key stats. 57 minutes ago. Analysis of the Schwab Fundamental Emerging Markets Large Co. Index ETF ETF (FNDE). Holdings, Costs, Performance, Fundamentals, Valuations and Rating. Learn everything you need to know about Schwab Fundamental Emerg Mkts Lg Co ETF (FNDE) and how it ranks compared to other funds. A list of holdings for FNDE (Schwab Fundamental Emerging Markets Equity ETF) with details about each stock and its percentage weighting in the ETF. 51 minutes ago. Get a real-time stock price quote for FNDE (Schwab Fundamental Emerging Markets Equity ETF). Also includes news, ETF details and other investing. Learn everything about Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE). News, analyses, holdings, benchmarks, and quotes. Explore FNDE for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Analyze Schwab Fundamental Emerging Markets Equity ETF (FNDE): check AUM and research returns, dividends, fund flows, and other key stats. 57 minutes ago. Analysis of the Schwab Fundamental Emerging Markets Large Co. Index ETF ETF (FNDE). Holdings, Costs, Performance, Fundamentals, Valuations and Rating. Learn everything you need to know about Schwab Fundamental Emerg Mkts Lg Co ETF (FNDE) and how it ranks compared to other funds. A list of holdings for FNDE (Schwab Fundamental Emerging Markets Equity ETF) with details about each stock and its percentage weighting in the ETF. 51 minutes ago. Get a real-time stock price quote for FNDE (Schwab Fundamental Emerging Markets Equity ETF). Also includes news, ETF details and other investing. Learn everything about Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE). News, analyses, holdings, benchmarks, and quotes.

Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE) Dividend History. Ex-Dividend Date 06/26/ Dividend Yield %. Get the latest Schwab Fundamental EM Equity ETF (FNDE) real-time quote, historical performance, charts, and other financial information to help you make. The Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE) made its debut on 08/13/, and is a smart beta exchange traded fund that provides. View the latest Schwab Fundamental Emerging Markets Equity ETF (FNDE) stock price and news, and other vital information for better exchange traded fund. 21 minutes ago. Schwab Fundamental Emerging MarketsEqETF (FNDE) ; Equity Style, Large Cap/Value ; Fixed Income Style, -- ; Broad Asset Class, International Equity ; YCharts. View Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE) ETF Profile from the issuer, including Top Holdings, Net Assets, Expense Ratio. Explore FNDE for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. A high-level overview of Schwab Fundamental Emerging Markets Equity ETF (FNDE) stock. Stay up to date on the latest stock price, chart, news, analysis. Schwab ETFs FNDE ETF (Schwab Fundamental Emerging Markets Large Company Index ETF): stock price, performance, provider, sustainability, sectors. FNDE tracks an index of emerging market stocks. Its selection and weighting are based on three fundamental factors: sales, cash flow, and dividends/buybacks. Schwab Fundamental Emerging Markets Large Company Index ETF FNDE tilts toward risky segments of the market that may not adequately compensate long-term. Schwab Fundamental Emerging Markets Equity ETF ETF holdings by MarketWatch. View complete FNDE exchange traded fund holdings for better informed ETF. Compare FNDE with any other ETF on performance, AuM, flows, costs, holdings, and liquidity. Schwab Fundamental Emerging Markets Equity ETF FNDE:NYSE Arca · Top 10 Holdings · Sector Weightings as of Schwab Fundamental Emerging Markets Large Company Index ETF | FNDE *Research Affiliates, LLC and its affiliates did not pay compensation directly or. Get Schwab Fundamental Emerging Markets Equity ETF (FNDE:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. The investment objective of the Schwab Fundamental Emerging Markets Large Company Index ETF seeks to track as closely as possible the total return of the. Check our interactive FNDE chart to view the latest changes in value and identify key financial events to make the best decisions. Schwab Fundamental Emerging Markets Large Company Index ETF · Snapshot. * · Top 10 Holdings · What is FNDE? · ETFs related toFNDE · Automated Strategies Related to.

Does Filing For Bankruptcy Affect Your Credit Score

:max_bytes(150000):strip_icc()/GettyImages-479975716-56a067f55f9b58eba4b04a3a.jpg)

Filing bankruptcy can cause your credit score to drop dramatically. If a lender is willing to accept your credit application despite your low score, it is. The bottom line is, a bankruptcy filing may hurt your credit score considerably, regardless of where you started. Duration of Bankruptcy on Your Credit Report. If you have good credit scores, filing for bankruptcy will definitely damage them. According to FICO (the most widely-used credit scoring company in the U.S.). Fact or Fiction: Filing for bankruptcy is the only thing that will ruin your credit. · Fact or Fiction: Personal bankruptcy destroys your credit score forever. How does bankruptcy affect my credit? Despite contrary counsel from credit counseling services, the fact is bankruptcy is the best remedy to a bad credit. If you have filed for Chapter 7 bankruptcy, once the bankruptcy court grants a discharge, all of the debts that were included in the bankruptcy will reflect. Even though the impact on credit scores may diminish over time, bankruptcy can continue to affect credit for as long as it's part of someone's credit reports. When you file bankruptcy, your credit scores can be negatively impacted almost right away. In fact, many consider bankruptcy as having the worst impact on your. In the short term, bankruptcy will absolutely lower your credit score significantly and will prevent you from getting credit—at least on any kind of favorable. Filing bankruptcy can cause your credit score to drop dramatically. If a lender is willing to accept your credit application despite your low score, it is. The bottom line is, a bankruptcy filing may hurt your credit score considerably, regardless of where you started. Duration of Bankruptcy on Your Credit Report. If you have good credit scores, filing for bankruptcy will definitely damage them. According to FICO (the most widely-used credit scoring company in the U.S.). Fact or Fiction: Filing for bankruptcy is the only thing that will ruin your credit. · Fact or Fiction: Personal bankruptcy destroys your credit score forever. How does bankruptcy affect my credit? Despite contrary counsel from credit counseling services, the fact is bankruptcy is the best remedy to a bad credit. If you have filed for Chapter 7 bankruptcy, once the bankruptcy court grants a discharge, all of the debts that were included in the bankruptcy will reflect. Even though the impact on credit scores may diminish over time, bankruptcy can continue to affect credit for as long as it's part of someone's credit reports. When you file bankruptcy, your credit scores can be negatively impacted almost right away. In fact, many consider bankruptcy as having the worst impact on your. In the short term, bankruptcy will absolutely lower your credit score significantly and will prevent you from getting credit—at least on any kind of favorable.

Yes it will affect your credit report - the bankruptcy will be reported on the credit report. I assume you also want to know whether it will. Personal bankruptcy is a legal process to eliminate debt, but there will be short term effect on your credit rating and credit score. Here is how bankruptcy. Many people worry that filing bankruptcy will severely impact their credit, and they are right in the sense that Chapter 7 bankruptcy can negatively affect your. While filing for bankruptcy can initially lower your credit score, wiping out your debt will help raise your credit score over the long term. Often, a person. Bankruptcy can stay on your credit report for either seven or 10 years, depending on what type of bankruptcy it is. If your credit was already poor due to a high debt-to-asset ratio (meaning the amount of debt is high compared to available credit) and account delinquency. Bankruptcy does not remain on your credit report forever. If you file Chapter 7 bankruptcy the filing will fall off your report after 10 years. If you filed. Chapter 7 bankruptcy stays on your credit report for 10 years after final discharge. Having a bankruptcy on your record for years does not mean it will. When you file for Chapter 7 bankruptcy, your credit score could take a hit of anywhere from to points. This impact will vary depending on whether your. Bankruptcy stays on your credit file for at least six years. This can make it hard to get credit, loans or a mortgage. Filing for bankruptcy negatively affects your credit rating while it remains on your credit report. Chapter 13 may cause less damage than Chapter 7 if you can. So your credit score and the impact bankruptcy has to your credit score really depends on various factors. There is a common incorrect belief. Bankruptcy is a “negative” entry when your credit score is being calculated, but the fact that a person filing for bankruptcy likely already has a low credit. Since most people filing for bankruptcy already have low credit scores, bankruptcy will likely have little impact on their credit scores. How Long Will. An August 7, report from the Federal Reserve Bank of Philadelphia found that the average credit score among those who filed Chapter 7 bankruptcy in What Was Your Credit Score to Begin With? If your credit is good and you file for bankruptcy, your credit score will take a hit by a few hundred points. · How. Filing for bankruptcy can lead to significant changes in one's financial life. You may wonder how it impacts your credit scores. Both have a long-term negative impact on your credit scores. A Chapter 13 bankruptcy or home foreclosure will stay on your credit reports for up to seven years. Bankruptcy is likely to drop your credit score to the lowest possible rating at most Canadian credit bureaus. That means lenders, insurers, landlords, employers. Filing bankruptcy has serious and long lasting consequences, including how it affects your credit, your credit score, and your credit rating. However, the.

Getting A Car Loan With Bad Credit

No matter what your credit score is, we can find you a lender who will be willing to give you an auto loan, so you can purchase the vehicle you need. Even if. Whether your credit history has made your credit score a or , we can find you auto financing. Get Started Now! It's Easy! Let's get you started on our. Our finance department specializes in helping those with no credit or bad credit get approved thanks to the relationships we have with dozens of local banks. Did you know that securing bad credit car loans is about more than your merely low credit score? When you apply for sub-prime car loans here, our finance pros. Will I be able to buy a car if my credit score is low? If your score is in the “poor” range, getting approved will be a challenge, but it certainly won't be. Poor credit car loans offer financial solutions that are designed specifically to assist those who have less than ideal credit. With the sizable volume of car. Credit Acceptance empowers car dealers nationwide to help people finance a car, regardless of bad credit or no credit. Start by applying for financing online to get pre-approved—and our knowledgeable team can help you figure out a payment plan that fits your budget. Your bad credit will require a high interest rate (and thus a higher payment), but your bad credit also implies that you probably can only handle a lower. No matter what your credit score is, we can find you a lender who will be willing to give you an auto loan, so you can purchase the vehicle you need. Even if. Whether your credit history has made your credit score a or , we can find you auto financing. Get Started Now! It's Easy! Let's get you started on our. Our finance department specializes in helping those with no credit or bad credit get approved thanks to the relationships we have with dozens of local banks. Did you know that securing bad credit car loans is about more than your merely low credit score? When you apply for sub-prime car loans here, our finance pros. Will I be able to buy a car if my credit score is low? If your score is in the “poor” range, getting approved will be a challenge, but it certainly won't be. Poor credit car loans offer financial solutions that are designed specifically to assist those who have less than ideal credit. With the sizable volume of car. Credit Acceptance empowers car dealers nationwide to help people finance a car, regardless of bad credit or no credit. Start by applying for financing online to get pre-approved—and our knowledgeable team can help you figure out a payment plan that fits your budget. Your bad credit will require a high interest rate (and thus a higher payment), but your bad credit also implies that you probably can only handle a lower.

First, you'll need to apply for financing on our site to get pre-approved. From there, you can work directly with our experienced finance team to develop a. How to get an auto loan if you have bad credit · 1. Check your credit score. · 2. Determine how much you can afford. · 3. Get pre-approved. · 4. Make a down payment. How to Get a Car With Bad Credit: Five Methods · Determine how much you can afford to pay. · Make a bigger down payment if possible. · Try to clean up your. Bad Credit Car Loans · Your debt-to-income ratio · Your detailed credit history · The amount you can provide as a down payment · The total loan amount requested. Jeff Belzer Auto Group offers bad credit car loans even if you've had a vehicle repossessed, a house foreclosed on, or even if you've gone through bankruptcy! Another perk of shopping with our dealership is that we can help you rebuild your credit score. Once our finance team has gotten you approved for an auto loan. There are no minimum qualifications to pre-qualify. Each auto loan application is evaluated based on the credit profile and equity position. An applicant with. What Steps Should I Take to Get a Car Loan with Bad Credit? · Determine your budget. · Attempt to make a larger downpayment if possible. · Check your credit score. We're here to help drivers, with less than favorable credit, learn all about the process of financing a new car with your financial standing. You can apply for financing on our convenient online form and get pre-approved. Then, you choose your next new or used car and agree on which payment plan is. Are you a DMV-area resident struggling to buy a car because you can't quality for an auto loan? The only way to defeat bad credit is to build good credit. Bad credit auto loans are special loans for shoppers whose credit history is poor, there is no minimum credit score requirement; instead, bad credit lenders. Are you a DMV-area resident struggling to buy a car because you can't quality for an auto loan? The only way to defeat bad credit is to build good credit. Types of lenders that offer car loans for bad credit · Banks and credit unions, known as direct lenders, are a good place to start. · Online loan marketplaces. Look at the dealers inventory and see what cars you like, go to the dealer last few days of the month are best, because they'll be a little more. Our subprime financing program can service people with an under credit score, making us the go-to destination for those looking to get a bad credit car. When you come to our bad credit car loan dealership, be prepared to bring items such as current pay stubs, driver's license, proof of insurance, a utility bill. Yes, it is possible to get a car loan even with no credit history or after bankruptcy. Bayer Motor Company is well-connected to a variety of financial. Contrary to popular belief, there isn't a single, universal credit score that you need to have to secure an auto loan. Lenders put together their lists of. We can start by finding a new or used car that meets your needs. Then we'll get you started with our pre-qualification form for sub-prime auto financing and get.

Cpa Exam Study Courses

CPA Courses are prep courses designed to help you pass all four sections of the CPA Exam. Typically delivered online, they include video lectures, multiple. Becker Course Options and Details. Like with all CPA exam prep courses, what you get depends on what you pay for. If you choose Becker CPA review, here are your. We provide students with unique prep courses for all major accounting credentialing exams, including the CPA exam. CPA Exam Prep · Study and sit for three sections of the CPA Exam prior to graduation; · Benefit from special SU student pricing on all CPA Exam review materials. The online CPA exam course leverages patented technology to help you pass all four CPA exams. The course helps you learn more efficiently, utilizing an. Becker CPA Exam Review offers CPA prep courses that are the gold standards in the exam prep market. That's why we've named Becker as our #1 rated CPA prep. Stay current on the latest trending topics with Becker's constantly growing CPE catalog of + unique on demand courses and 1,+ webcast courses — written. Pass the CPA Exam with UWorld CPA Review, the only CPA test prep that includes top accounting instructors like Roger Philipp (CGMA, CPA) and Peter Olinto (CFA. Review Courses ; Pass Rate, 94%, 92% ; Mobile App ; Instruction Hours, + hours of lectures, + videos ; Study Planner. CPA Courses are prep courses designed to help you pass all four sections of the CPA Exam. Typically delivered online, they include video lectures, multiple. Becker Course Options and Details. Like with all CPA exam prep courses, what you get depends on what you pay for. If you choose Becker CPA review, here are your. We provide students with unique prep courses for all major accounting credentialing exams, including the CPA exam. CPA Exam Prep · Study and sit for three sections of the CPA Exam prior to graduation; · Benefit from special SU student pricing on all CPA Exam review materials. The online CPA exam course leverages patented technology to help you pass all four CPA exams. The course helps you learn more efficiently, utilizing an. Becker CPA Exam Review offers CPA prep courses that are the gold standards in the exam prep market. That's why we've named Becker as our #1 rated CPA prep. Stay current on the latest trending topics with Becker's constantly growing CPE catalog of + unique on demand courses and 1,+ webcast courses — written. Pass the CPA Exam with UWorld CPA Review, the only CPA test prep that includes top accounting instructors like Roger Philipp (CGMA, CPA) and Peter Olinto (CFA. Review Courses ; Pass Rate, 94%, 92% ; Mobile App ; Instruction Hours, + hours of lectures, + videos ; Study Planner.

GSCPA Member Discounted Review Courses · Becker Professional Education · Gleim CPA Review · Lambers CPA Exam Review · UWorld Roger CPA Review · Surgent CPA Review. For the CPA's out there, who offers the best prep courses? Ideally similar to Danko for the CFP world. The 5 Best CPA Review Courses in Becker CPA Review, UWorld Roger CPA Review, Surgent CPA Review, Gleim CPA Review, and NINJA CPA Review. CPA Prep / Review Courses · Becker Professional Education · Gleim CPA Review · Roger CPA Review · Surgent CPA Review · Yaeger CPA Review. Becker's CPA prep courses include four comprehensive review packages, ranging in cost from $2, to $4, Becker also offers single-section study guides and. Take an innovative approach to CPA exam preparation with Emmanuel's School of Business & Management and Graduate & Professional Programs in partnership with. The review course is divided into mini courses, aligning with the CPA exam. The review courses run consecutively, focusing on 1 part of the exam at a time. 94% of our students pass the CPA Exam. Explore course options below to find the study materials right for you. Get ready for an enhanced CPA Exam prep. Becker CPA Review Becker CPA Review is the most expensive, most popular, and most searched company because it is the biggest name in CPA Exam prep. The four. The UCLA Extension Accounting Certificate is now an 8-course (previously 9-course) program. Accounting Certificate coursework covers core exam subject matter. Unlike other traditional CPA review courses, Universal CPA offers a visual approach to its task-based simulations. Studying for task-based simulations can feel. on our unlimited access course! UWorld Roger CPA Review delivers exceptional course materials that make difficult concepts easy to understand. We know that. Surgent CPA Review is a great choice for CPA candidates looking to master their certification exam. If you want to learn the ins and outs of public accounting. Best CPA Review Courses (August ): 27 Things To Know. Becker CPA Review vs UWorld CPA Review vs Gleim CPA Review vs Surgent CPA Review vs NINJA CPA. The best and simplied combination I can recommend is LIVE classes from Vishal CPA Prep for FAR & BAR with his summarized study notes. We've helped accountants pass over 1 million CPA exams. The largest test bank on the market, over hours of videos, our Access Until You Pass® Guarantee. Pass the CPA Exam with confidence! Surgent CPA Review utilizes an award-winning learning platform, A.S.A.P. Technology™, a proprietary adaptive approach to. Universal CPA Review is the only CPA review course that offers visually-driven video lectures in a bite-sized manner that will help you retain information. Industry-Leading Material: Becker offers the most current and comprehensive CPA study materials, designed by seasoned accounting experts. These dynamic courses.

Annuity Death

Standard Death Benefit. This is the simplest option. With the standard death benefit, your beneficiary receives the current annuity's account value, regardless. What if I die before my income payments start? This is an important question for estate planning. Your beneficiary may want to cash in the annuity. Ask your. Annuities are very popular investments by the elderly, so they are common assets for survivors to deal with after the death of a loved one. The money in a qualified annuity is sheltered from income taxes while it is in the account. When the death benefits are paid out, the IRS considers these. On behalf of New York Life, please accept our sincere condolences during this difficult time. In the following pages, you will find the Death Benefit Proceeds. Availability of an Enhanced Estate Benefit (typically an extra 25% – 40% of the account value, and in some cases the greater of the account value or the roll-up. If the owner/annuitant dies prior to initiating annuity payments, the named beneficiary would receive the death benefit. However, if annuity payments have begun. “The Iowa Life & Health Insurance Guaranty Association is a statutory entity created in [by] the Iowa Legislature The Guaranty Association is. If a CSRS retiree dies, recurring monthly payments may be made to the surviving spouse if the retiree elected a reduced annuity to provide the benefit. To. Standard Death Benefit. This is the simplest option. With the standard death benefit, your beneficiary receives the current annuity's account value, regardless. What if I die before my income payments start? This is an important question for estate planning. Your beneficiary may want to cash in the annuity. Ask your. Annuities are very popular investments by the elderly, so they are common assets for survivors to deal with after the death of a loved one. The money in a qualified annuity is sheltered from income taxes while it is in the account. When the death benefits are paid out, the IRS considers these. On behalf of New York Life, please accept our sincere condolences during this difficult time. In the following pages, you will find the Death Benefit Proceeds. Availability of an Enhanced Estate Benefit (typically an extra 25% – 40% of the account value, and in some cases the greater of the account value or the roll-up. If the owner/annuitant dies prior to initiating annuity payments, the named beneficiary would receive the death benefit. However, if annuity payments have begun. “The Iowa Life & Health Insurance Guaranty Association is a statutory entity created in [by] the Iowa Legislature The Guaranty Association is. If a CSRS retiree dies, recurring monthly payments may be made to the surviving spouse if the retiree elected a reduced annuity to provide the benefit. To.

Key Takeaways · Death benefits in a variable annuity (VA) may be triggered by the death of the annuitant or the contract owner. · Fees for a VA death benefit. Most Pacific Life variable annuities include a standard death benefit equal to the contract value. We also offer optional death benefits that give clients the. If no Beneficiary has been designated, or your Beneficiary predeceases you, your Beneficiary is the beneficiary you designated to receive death benefits from. If you die as a retiree, your beneficiaries could receive: Payment of any retirement contribution remaining in your account if you chose the Standard Annuity. When an annuity owner dies, the beneficiary receives the remaining value or a guaranteed minimum amount based on the contract terms. If an employee dies and no survivor annuity is payable based on his/her death, the retirement contributions remaining to the deceased person's credit in the. When an annuity's owner or annuitant dies, the contract pays a death benefit to the named beneficiary. This death benefit could represent the remaining. There are no further payments to anyone after your death. Life with Period Certain. The annuity income benefit is paid for as long as you are alive. The company. Selecting a joint life annuity will generally provide a lower level of income for you in your lifetime. Related Questions. A beneficiary is a person who will receive benefits from an annuity after the annuitant dies. You can choose one beneficiary or several, and specify how much. Death benefit. In some annuity contracts, the company may pay a death benefit to your beneficiary if you die before the income payments start. The most. “Per stirpes” is a Latin term that means, literally, “my branch.” Insurance companies usually will allow an annuitant to designate any beneficiary as “per. Basic Employee Death Benefit. Surviving Spouse. If an employee dies with at least 18 months of creditable civilian service under FERS, a survivor annuity may be. Yes, in almost all cases, annuities can be inherited. The exception is if an annuity is structured with a life-only payout option through annuitization. This. Allianz Life offers annuities, life insurance, and Buffered ETFs that can help you manage risks to your retirement security. Joint life, nominee or successor's annuities, annuity protection lump sums and income due under a guarantee period are taxed at the marginal rate of the. What documents are required when a claim for death benefits is being filed? Original annuity contract, if available; A certified copy of the death certificate. Availability of an Enhanced Estate Benefit (typically an extra 25% – 40% of the account value, and in some cases the greater of the account value or the roll-up. Nationwide offers one of the only spousal protection features on variable annuities with IRA contracts. Learn more about the Spousal Protection Feature (SPF). Pacific Life offers a variety of annuities designed to help grow, protect, and manage retirement savings turning it into steady, reliable lifetime income.

Street Bike Insurance Cost

The average motorcycle insurance policy is $ across the US. Several factors play into the equation, though. This can fluctuate as much as $$ Get a free California motorcycle insurance quote today. Nationwide offers reliable coverage that keeps you and your motorcycle protected. With Progressive, you can get liability insurance on your sport bike for as low as $75/year. Depending on the type of bike you have and the amount of coverage. The average cost of motorcycle insurance in Ontario ranges from $1, to $3, a year. However, there are several factors that insurance companies take into. I pay $69 a month for the very top coverage through All-State for my KTM ADV. I was quoted $ monthly through Geico and $ a year. Customizable motorcycle coverage options. Call for a quote today. However and wherever you ride, you know a motorcycle has unique risks. The cost of motorcycle insurance in the United States is estimated to be $60 per month or $ per year on average; however, your specific premium will be. Given the nature of a sport bike, it can be expensive to insure. In fact, a young rider insuring a cc bike may have to pay an insurance premium that rivals. Motorcycle insurance can help protect you and your motorcycle. Get a fast and free motorcycle insurance quote to explore your options with Allstate. The average motorcycle insurance policy is $ across the US. Several factors play into the equation, though. This can fluctuate as much as $$ Get a free California motorcycle insurance quote today. Nationwide offers reliable coverage that keeps you and your motorcycle protected. With Progressive, you can get liability insurance on your sport bike for as low as $75/year. Depending on the type of bike you have and the amount of coverage. The average cost of motorcycle insurance in Ontario ranges from $1, to $3, a year. However, there are several factors that insurance companies take into. I pay $69 a month for the very top coverage through All-State for my KTM ADV. I was quoted $ monthly through Geico and $ a year. Customizable motorcycle coverage options. Call for a quote today. However and wherever you ride, you know a motorcycle has unique risks. The cost of motorcycle insurance in the United States is estimated to be $60 per month or $ per year on average; however, your specific premium will be. Given the nature of a sport bike, it can be expensive to insure. In fact, a young rider insuring a cc bike may have to pay an insurance premium that rivals. Motorcycle insurance can help protect you and your motorcycle. Get a fast and free motorcycle insurance quote to explore your options with Allstate.

Get the motorcycle insurance coverage you need at USAA Insurance Agency. Get a quote today and make sure that you and your bike are protected. Due to sharing the road with larger vehicles, street motorcycle insurance is inherently more costly than dirt bike insurance. Most states require you to carry a. As you know, motorcycle insurance rates vary dramatically based on the make and model of bike being insured. Sport bikes, known as “supersports” within the. Average cost of Progressive motorcycle insurance by state ; Low-cost states · $ · $ ; Medium-cost states · $ · $ ; High-cost states · $ We can help you find affordable motorcycle insurance rates and great coverage no matter what type of bike you have. We can help you find affordable motorcycle insurance rates and great coverage no matter what type of bike you have. There are many things you can do to make sure you are getting the best rate today or to help reduce your costs in the future. How does pay per mile sport bike insurance work? Instead of paying an annual flat fee, your insurance rate is based on your actual mileage. If you ride less. Best motorcycle insurance · Best for various types of motorcycles: State Farm · Best for availability: Progressive · Best for bundling: Geico · Best for discounts. GEICO's Motorcycle Insurance Offers You: You'll never have to sacrifice great coverage for a cheaper price. Review your FREE motorcycle insurance quote today. Liability insurance is designed to provide you financial protection if your sport bike causes damage to another person or their vehicle. This is the basic. Your premium for motorcycle insurance will depend on many factors. Where you live, your driving record, the type of motorcycle, and how much your bike costs to. Get a free motorcycle insurance policy quote online. Prices as low as $7/mo. High-quality protection trusted by riders for 50+ yrs. Motorcycle Insurance. Find more freedom on the open road with coverage that goes anywhere you go. From mopeds to muscle bikes, two wheels need the same. Average rates for drivers who are between 25 to 60 years old and choose the basic liability coverage for a touring bike are typically between $$ annually. Get a free motorcycle insurance quote to see how much you could save with our discounts. Customize your motorcycle coverage and only pay for what you need. Roadway Auto Insurance provides some of the best rates for motorcycle insurance. You might get discounts by insuring multiple vehicles with us, keeping a clean. Motorcycle insurance is essential for meeting your state's minimum coverage requirements and handling the cost bike, we can also cover your car and more. Cover your favorite bike with motorcycle insurance from The General®. Get a free motorcycle insurance quote today and get ready to hit the open road! And our new motorcycle insurance rates offer the lowest possible cost for the safest drivers on the road. Insuring your motorcycle with ERIE means: Your.